July 18, 2023

Underwriting, 90’s music and trying to predict the Superhoops

It was the mid-90s. Oasis were topping the charts, and QPR were 5th in the Premier League. I was just starting my first job at Lincoln National. It was a good time to be earning my first pay packet. And a great time to be enjoying some independence and responsibility.

During those early days as an underwriter, the process was slow. Everything was manual. Paper applications were delivered by the postman. We stamped them and put them into filing cabinets. We faxed them to doctors’ surgeries and reinsurers. And we spent the day on the phone with financial advisers and clients. There wasn’t much automation, but we did give our customers the human touch!

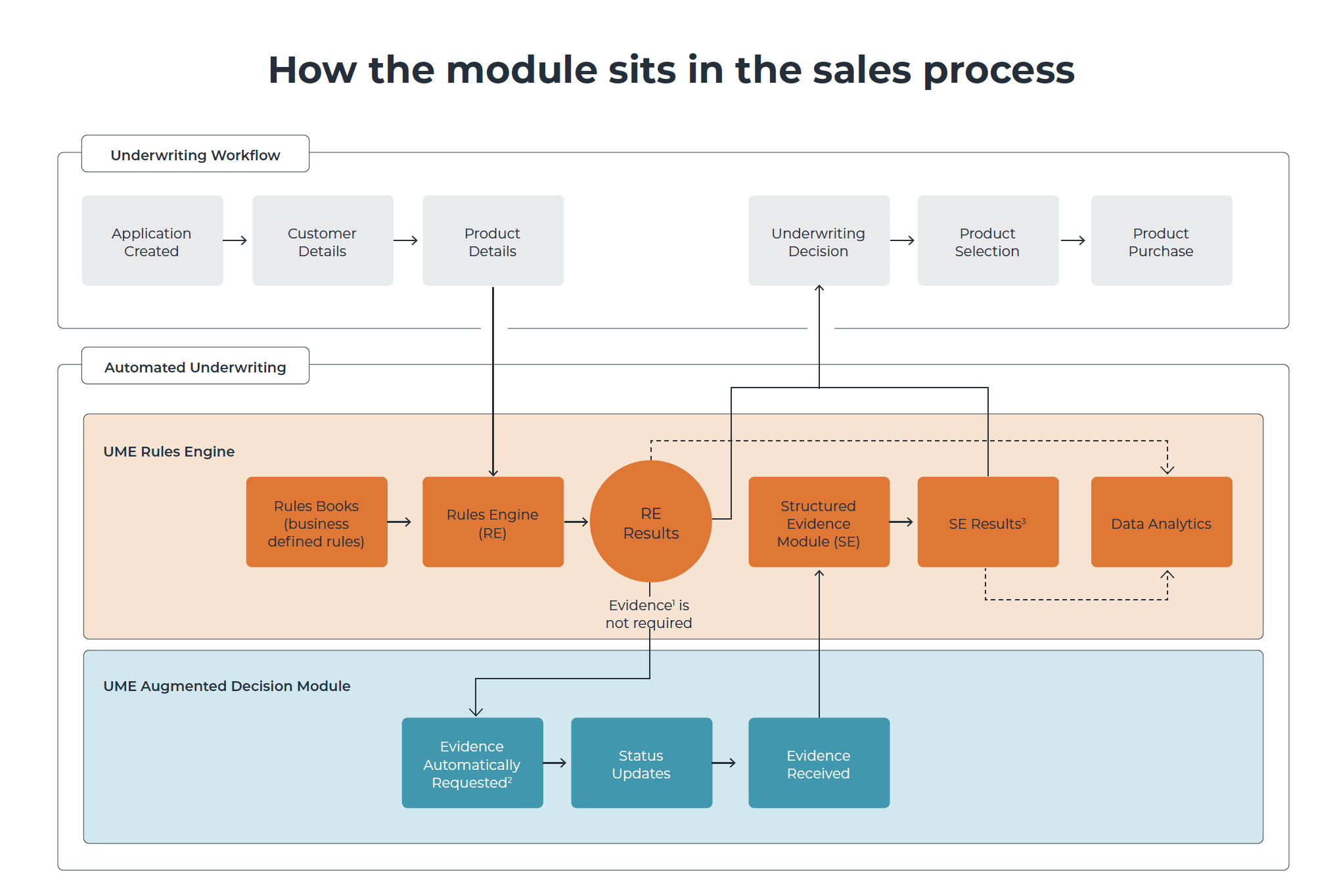

Products such as UnderwriteMe’s Underwriting engine massively changed underwriting. Within years, most applications were underwritten online, with far fewer manual and admin tasks. That freedom meant that we could focus on what was interesting and important. We were able to spend more time with clients and brokers that needed our support. And underwriting continued to be the vital cog in the protection wheel it had always been. We added new skills that were needed for this new world, such as programming, data analysis, and testing.

This was a big step forwards in a short space of time. However, inefficiencies in the underwriting process still remain. If you’re not one of the 70% of our healthier customers, it can remain a long, laborious, and manual process. One that is still reliant on paper reports and admin processes. And this means we still retain frustrated and disengaged customers and brokers.

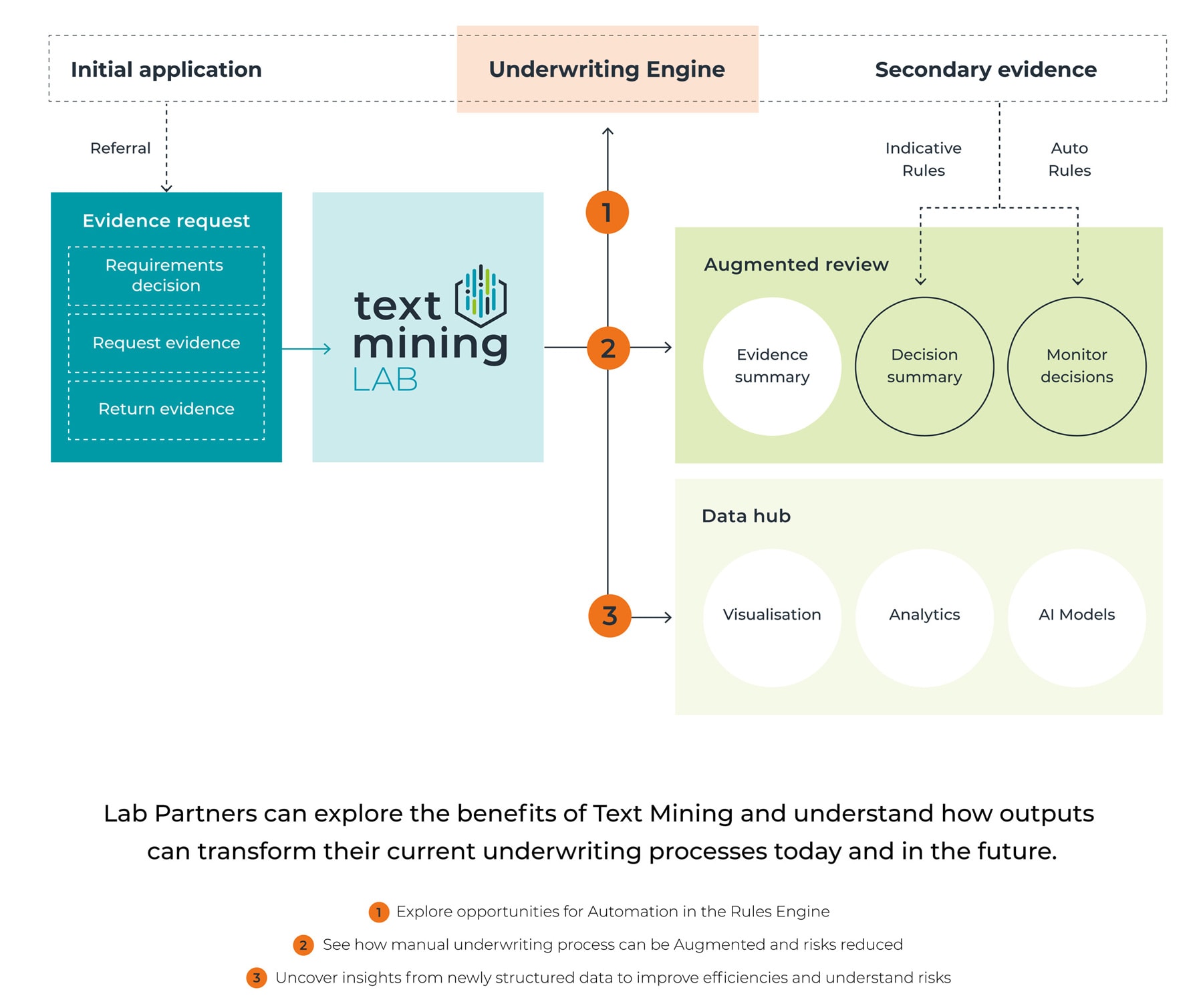

We are though at the start of another technological revolution. One that will once more challenge us Underwriters to evolve and broaden our skills. In the same way that underwriting engines took the heavy burden of admin tasks and complex applications, new products will make more efficiency savings. Products like UnderwriteMe’s Decision Platform are already on the market. It will read unstructured data, digest medical reports and automatically underwrite them. Our team have seen an application with medical evidence go live in 2-working days, in a process that usually takes 2-weeks to complete. Using these products will give us a wealth of data that we’ve not had before. We will start to understand customer disclosure and buying behaviour in far better detail. And, by doing so, we will build more efficient models that predict underwriting ratings, or the likelihood of purchase and lapse – without human underwriter intervention.

Another underwriting revolution is on the way. Underwriters will remain as important to the protection process as they always have been but will have to adapt and evolve their skills in the same way we older underwriters did 20 years ago. Underwriters will need to be up for the challenge and embrace digitalisation. Even newer skills are needed, in data science, more complex programming and an understanding of models and machine learning. But underwriters will complement the new tech. We will always need those valuable medical and risk skills, and customers and brokers will still want the personal touch. Relationship building and trust will still be key.

Some things won’t change though. Rather than embracing new music. You’ll still hear Oasis blasting out on my Alexa. And, more out of hope than expectation, I still watch my football team fall down the leagues.

Steve Baldry

Director, Underwriting, UnderwriteMe