July 11, 2024

Transforming Life Insurance Underwriting – The Power of Natural Language Processing

In today’s fast-paced world, we are constantly looking for ways to improve efficiency, reduce costs, and enhance customer satisfaction. Underwriting is no different, and at UnderwriteMe, we understand the challenges faced by underwriters who are trying to assess complex healthcare records with manual processes.

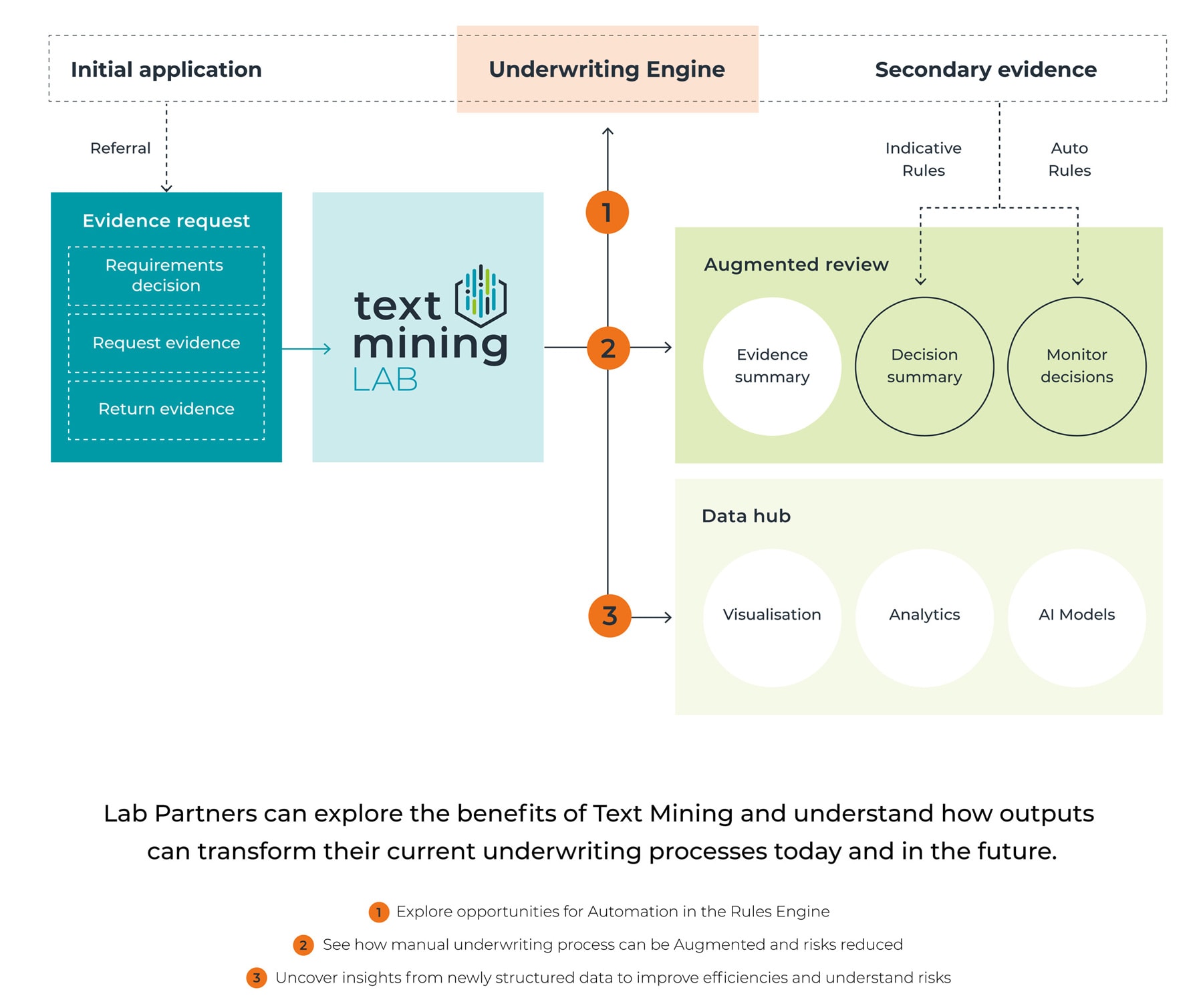

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and human language. It enables computers to understand, interpret, and generate human language in a way that is valuable. Meet our NLP-powered underwriting solution, designed to empower underwriting teams and revolutionise the way risks are assessed. Developed with a focus on Life Insurance underwriting to reduce turnaround time and operational costs.

Recognising Underwriting Challenges

Underwriting Life Insurance applications often involves meticulous analysis of an applicant’s healthcare records which covers their medical history and lifestyle factors. This process poses several challenges:

- Time-Consuming: Manually reviewing healthcare records can be a lengthy process with an extensive record, often leading to delays in assessment and policy issuance.

- High Costs: The extensive manual work involved in underwriting increases operational costs for insurance companies.

- Complexity of Data: Unlike other industries where data might be more structured and straightforward, Life Insurance underwriting relies heavily on unstructured data sources such as Word files, PDF files, and images. Such data doesn’t have a standard format for efficient access by software. In contrast, structured data is organised and easily searchable, often found in databases and spreadsheets with defined fields. Healthcare records, for example, can be complex and contain vast amounts of unstructured data that are difficult to analyse efficiently without advanced tools.

How NLP Transforms Life Insurance Underwriting

At UnderwriteMe, we use NLP to transform Life Insurance underwriting, addressing the traditional challenges head-on.

- Automated Data Extraction: Our NLP technology can automatically extract key information from healthcare records, identifying relevant data points such as symptoms, medical investigations, diagnoses, treatments, and lifestyle factors. This automation eliminates the need for manual assessment, transforming unstructured healthcare reports into structured data points. It highlights potential risk factors (e.g. pre-existing medical conditions, lifestyle factors and any relevant family history) associated with an applicant, providing underwriters with clear, summarised insights to make informed decisions quickly.

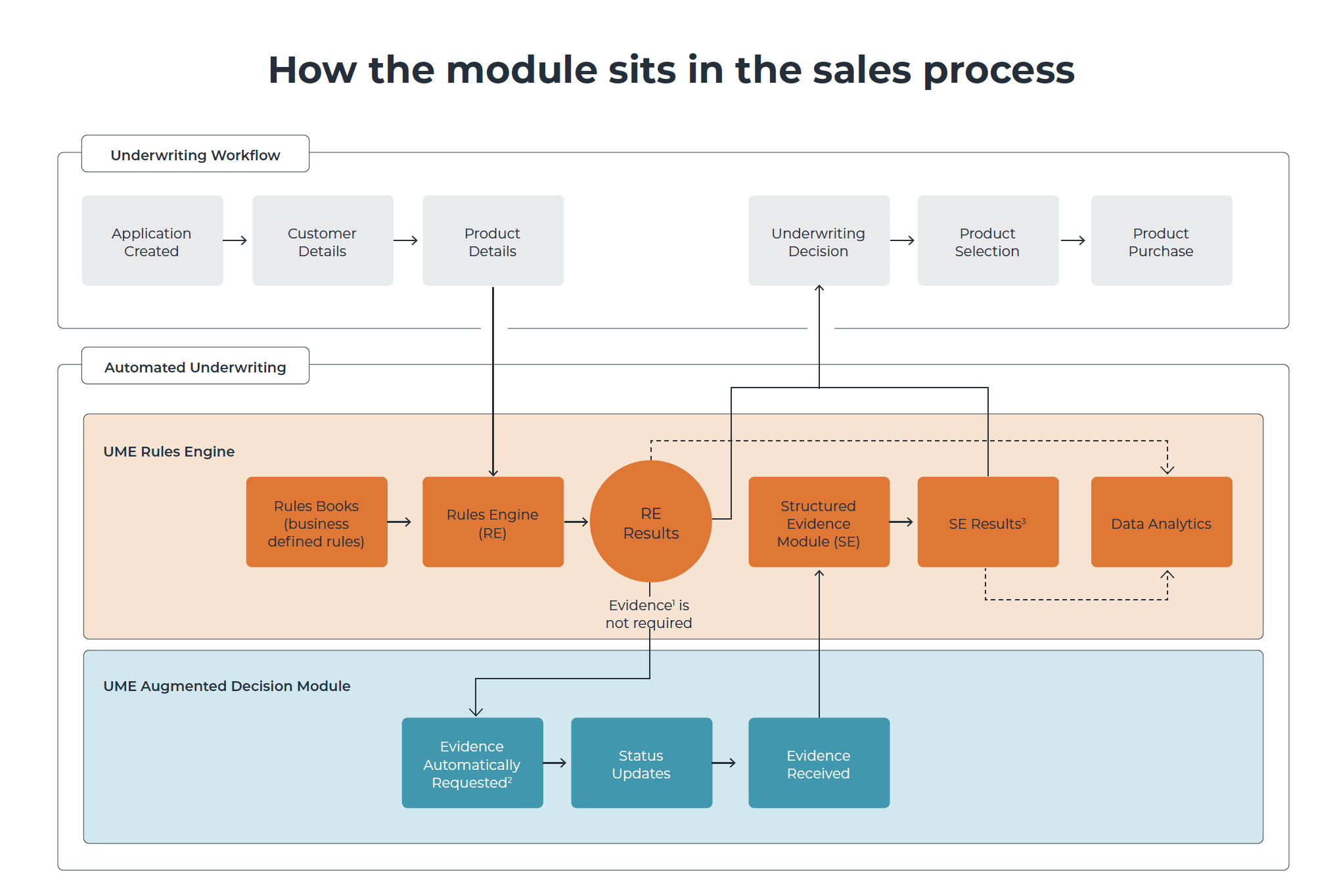

- Integration with Rule Engines: The structured risk report generated by our NLP technology is not only beneficial for underwriters but also readable for computers. Integrating our NLP-powered underwriting solution directly with our market leading Underwriting Rules Engine is for some the holy-grail of underwriting automation. Allowing insurers to seamlessly connect digital health information with underwriting decision making processes. The combination of AI technology and predetermined rules allows insurers to maintain robust risk controls whilst significantly boosting their automation potential.

Reduced Turnaround Time and Cost

Experienced underwriters are highly trained and skilled professionals and in demand. It can take years of training and development to reach a high level of expertise. By leveraging NLP, risk assessment can achieve greater levels of consistency, improving underwriting efficiency and establish a clearer audit trail for justification of the decision made. Building Scale, Trust, and Loyalty.

As an industry, we aim to provide the best service to our customers, but how modern are the processes behind it? Bottlenecks in the traditional underwriting process can delay policy issuance, causing frustration for applicants and increasing costs for insurers. Our product introduces smoother processes that speed up underwriting decisions, delivering improved With faster response times and smoother workflows, insurers can scale up their operations, build increased trust, loyalty, and lasting relationships with their customers which should increase conversion rates from an application to a policy.

Streamline your underwriting process today! Visit our website or contact us to learn more about our NLP solutions – hello@underwriteme.co.uk