April 3, 2024

From Manual to Modern: Revolutionising Claims Processing in 2024!

By Chukwuwezam Obanor, Product Manager, UnderwriteMe

Revolutionising Claims Management: Questioning the Status Quo in Life Insurance

We live in an era where the demand for speed, efficiency, and transparency in service delivery has never been higher. Need to do some shopping? Order online, get it tomorrow. Need a loan? Get it right now, no need for calls. Need life insurance? Sure! Request today, get it next year. I’m joking, that used to be the case but not anymore. Depending on the product, you can get life insurance within a matter of hours or days, but in many cases what you can’t get within hours or days is the claim payment.

Here’s a question for insurers:

Should someone whose grandma died have to wait 2 weeks to get the claim on an insurance policy she’s held for 45 years, even though there is a 99.8% likelihood it would be approved?

Most (if not all) would certainly say NO.

Should there be consistency across decisions made on income protection claims? Most insurers would say YES! However, neither of these desired outcomes is easy to achieve without adopting new methods and technology.

The insurance industry is not a laggard when it comes to innovation, however, claims automation is stifled by dated processes.

What are these processes and why do we hold on to them?

The claims reporting process – Is Personal Touch Irreplaceable?

Manual reporting of claims is crucial for information gathering, especially in the intricate cases of income protection claims. Our position is that technology can complement this by enabling a hybrid approach, where automation streamlines the straightforward cases, allowing human expertise to focus on complex situations that require deeper engagement.

A combination of automation and human touch where appropriate would offer a faster, cheaper, and more consistent process to insurers without losing the benefit of personal touch and engagement that claims assessors provide.

Automation can enable straight through assessment of the large proportion of claims where a ‘light touch’ approach is preferred. For most death claims, automation offers the possibility of straight through assessment and perhaps same day payment. For more complex cases, automation can support the consistent application of an insurer’s claims philosophy and assist with accurately identifying opportunities for active case management or ‘red flags’.

Does Manual Processing Achieve Accuracy?

The short answer is Yes. Claims assessors spend on average 5 – 10 years training to become extremely skilled at handling cases of any complexity level. Well in that case, why bother automate? Because Claim Engines can significantly improve the speed of decisioning without any loss in accuracy. For instance, UnderwriteMe’s claims engine provides a customisable ruleset that enhances accuracy, boosts decision consistency, speed, and appropriate application of the insurer’s claim philosophy to each case.

Does the initial investment outweigh the long-term benefits?

The cost of implementing claims automation is often cited as a barrier. Yet have we fully considered the long-term savings and efficiencies gained through such an investment? When we started UnderwriteMe 14 years ago, we reasoned that perhaps the underwriting process could become 30%, maybe 50% more efficient. Today, for some insurers , straight-through processing accounts for around 80% of their underwriting and the industry spends significantly less on underwriting each case than when we started.

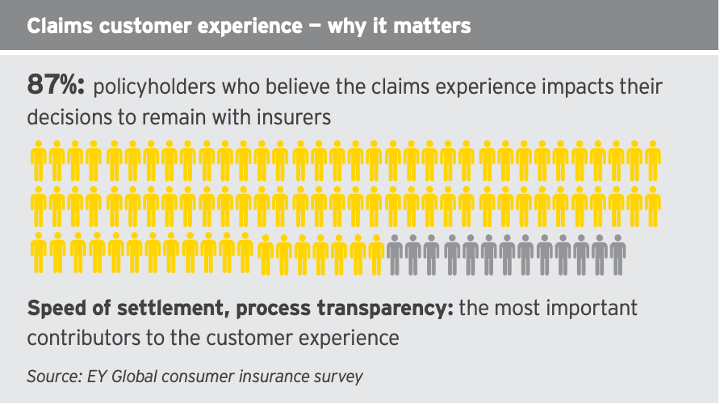

Similarly, the initial expenditure on claims automation will lead to substantial cost savings, higher customer satisfaction, and competitive advantage in the long run.

To the chief underwriters, claim assessors, COO’s, CTOs, CFOs, CEOs, and innovation leaders in the protection industry: the future is not just about preserving the past but refining our capabilities using today’s technologies. So come along with us on a journey to re-imagining the claims process.

Book a demo with us here and find out more about how we can supercharge your claims process.