August 25, 2022

UnderwriteMe reaches 1 million case milestone on its Protection Platform as Mortgage Advisers applaud time saved

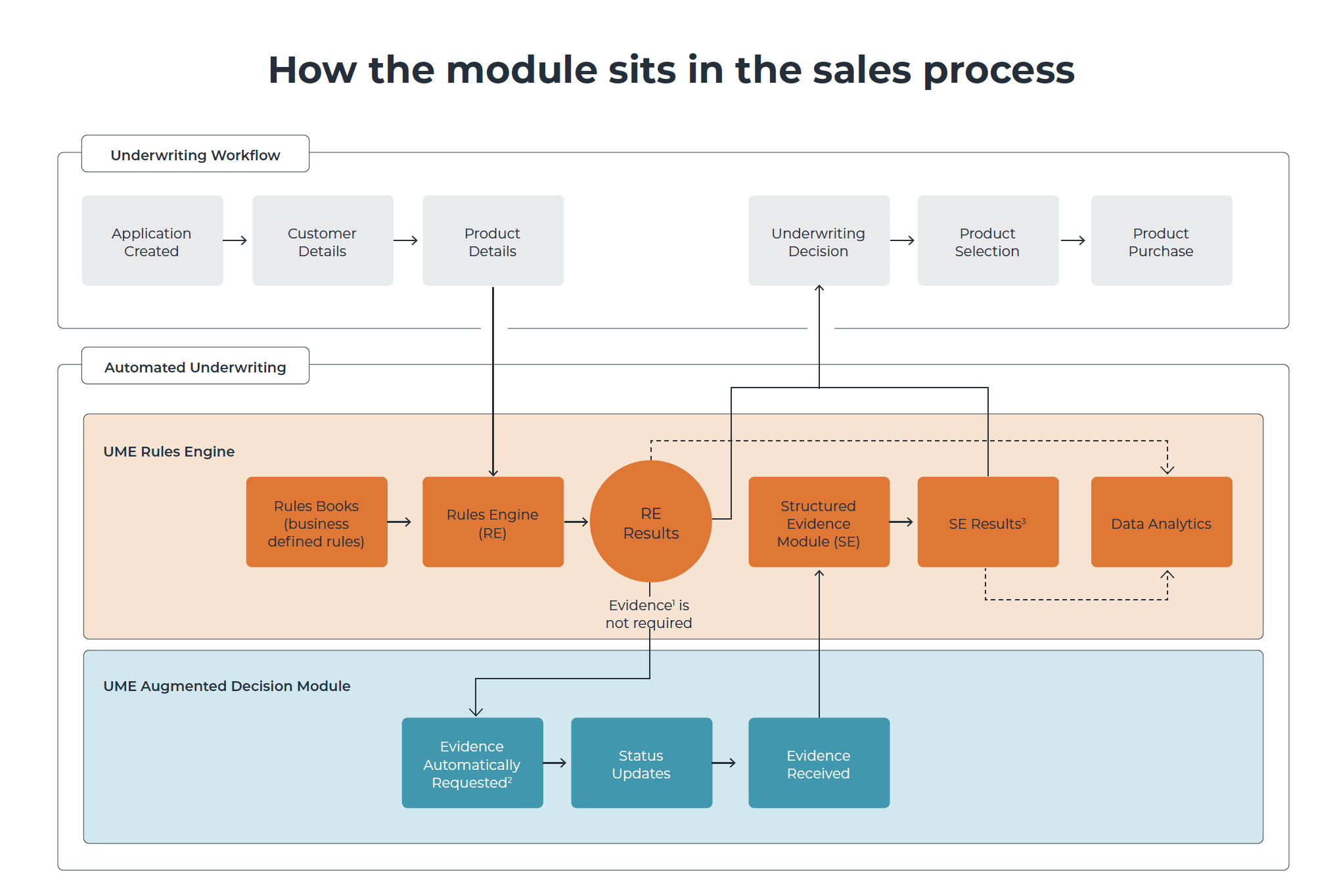

Insurtech leader, UnderwriteMe has just reached a significant milestone as the number of cases submitted through its Protection Platform passes 1 million. Launched in 2018, the Protection Platform helps advisers compare multiple products from multiple providers in one place. It delivers pre-sale underwritten premiums and provides automated and instant underwriting decisions for more than 90 percent of all protection cases.

UnderwriteMe designed the Protection Platform to help advisers simplify their sales processes and are continuing to add product providers to the system. Advisers can quote, underwrite and apply online from the majority of popular UK insurers. Since its launch, 762 adviser firms and more than 4,350 individual advisers are submitting cases on Protection Platform.

Perhaps most importantly, the Protection Platform saves valuable time for advisers.

UnderwriteMe CEO James Tait said, “We’re delighted to have passed this significant milestone in UnderwriteMe’s development. Not only are we allowing advisers to deliver buy-now prices to their clients, but we’re also helping them cut processing time. Mortgage Advisers, in particular, have historically found the protection application process too laborious on top of all the usual mortgage paperwork. It sometimes puts them off talking about protection at all. The Protection Platform cuts process times and makes it easier for Mortgage Advisers to include protection in their recommendations.”

Daniel Hobbs, Managing Director of New Leaf Distribution added, “Our advisers are saving 1-2 hours per case using UnderwriteMe. That’s amazing. With that time saved they can go on and protect even more families which is great news for our industry.”

Vincent O’Connor, Director of Products at The Right Mortgage and Protection Network said, “We know there’s a considerable risk of clients not taking the cover if their quoted premium turns out only to be an ‘estimate’. To me, that doesn’t really fit with Consumer Duty. Being able to quote underwritten premiums up-front helps remove that risk.”

UnderwriteMe have put together a short video demonstrating the advantages of Protection Platform.