October 17, 2017

Pacific Life Re forms partnership with Singapore Life to launch UnderwriteMe in Asia

Pacific Life Re forms a partnership with Singapore Life to launch UnderwriteMe in Asia Singapore (9th October 2017) – In partnership with Pacific Life Re, Singapore Life has become the first insurer in Asia to offer the UK’s leading Underwriting Rules Engine to drive its sales via their distribution channels, including online Direct-to-Consumer.

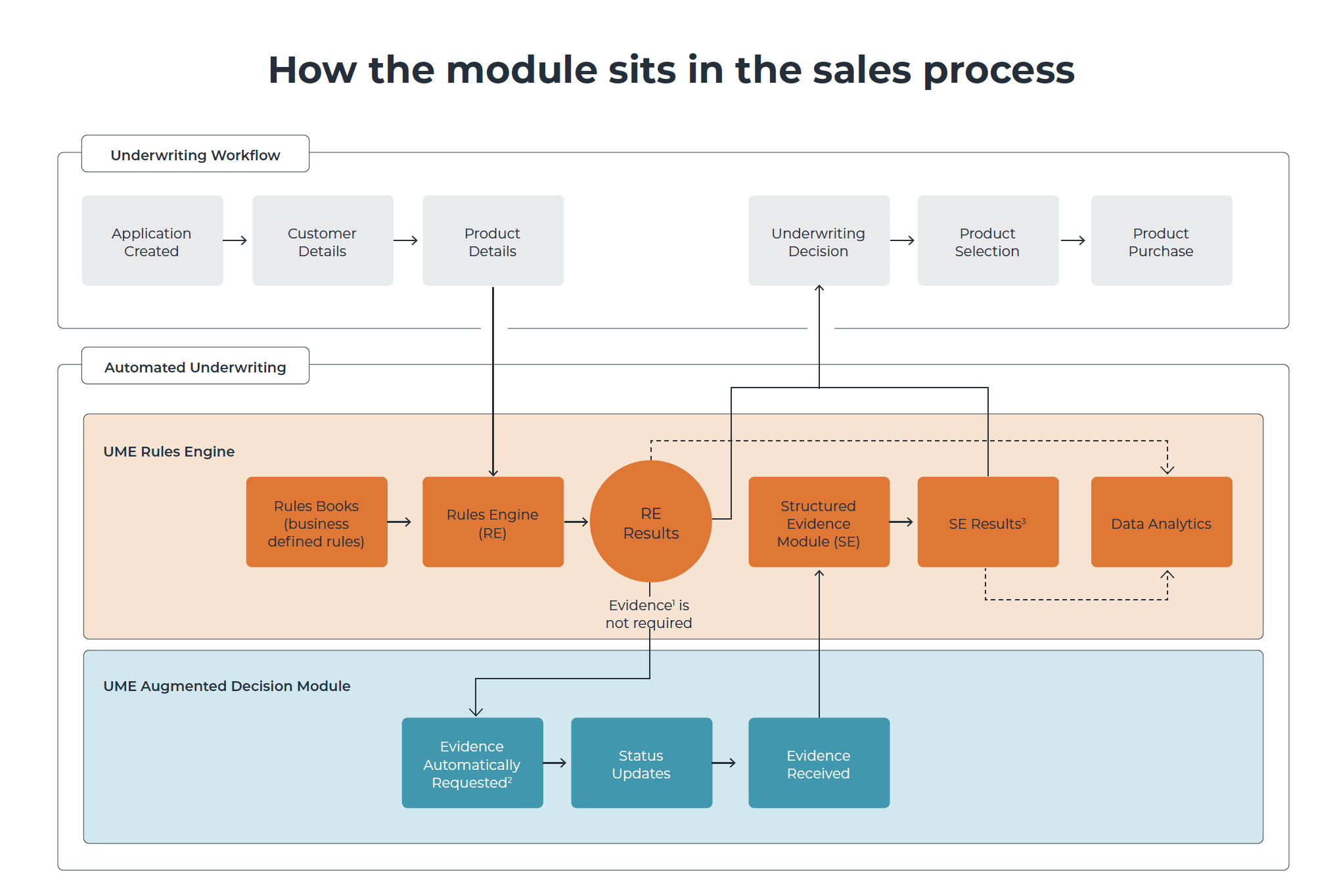

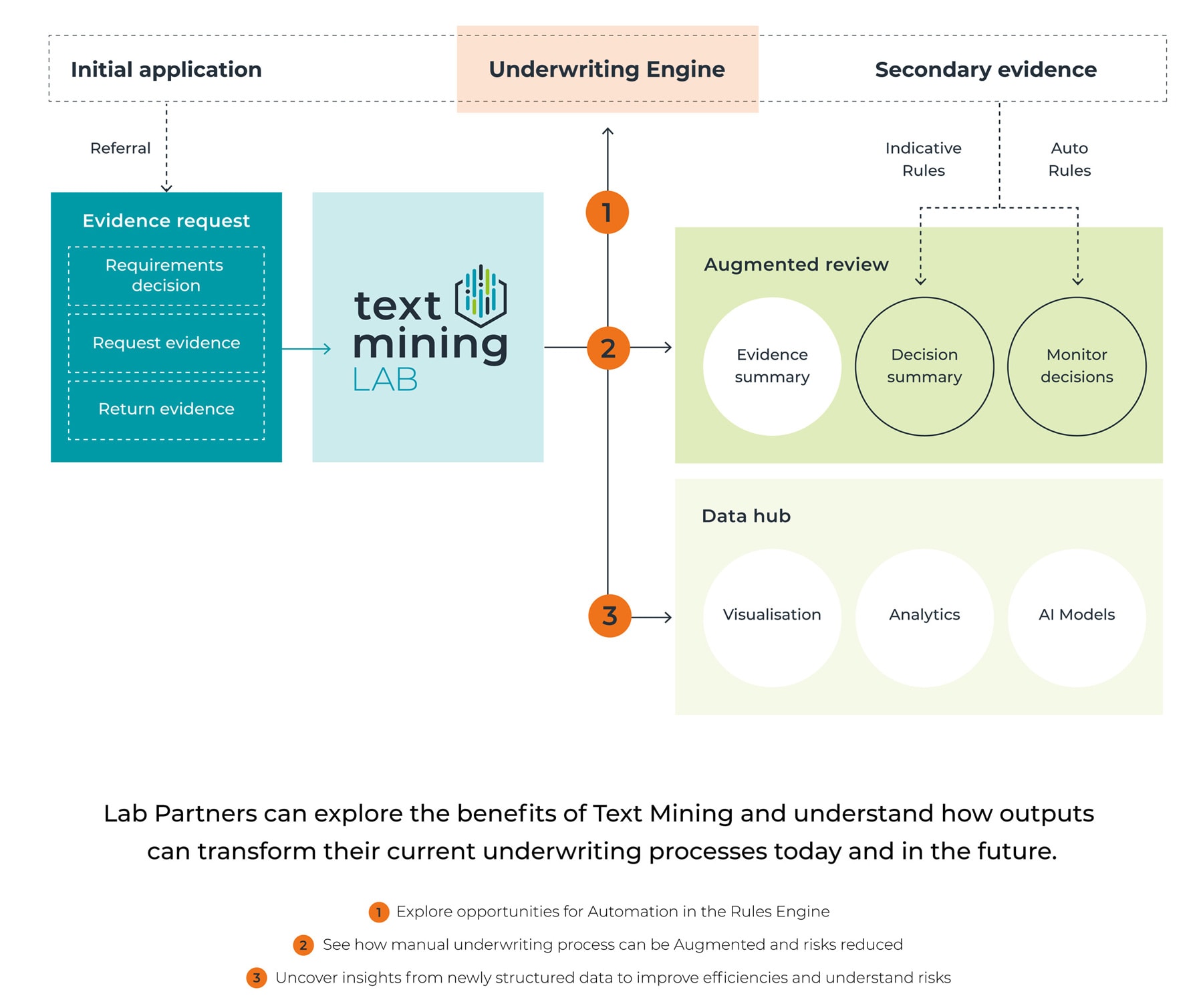

The Underwriting Rules Engine was developed by UK technology firm, UnderwriteMe, which was established in 2012. It incorporates Pacific Life Re’s slick underwriting rules, enabling questions to be customised according to unique customer profiles. The system also allows multiple risks to be assessed concurrently, resulting in a reduced number of questions and a much shorter application process for customers.

Alex King, Managing Director, Pacific Life Re Asia, said,

“This is a significant achievement for both Pacific Life Re and UnderwriteMe. Pacific Life Re is known for its innovative approach in meeting the needs of the market, and combined with UnderwriteMe’s digital solutions which are adapted to the Asian context, further strengthens our reinsurance proposition to our clients.”

UnderwriteMe’s Underwriting Rules Engine is expected to drive significant efficiencies for Singapore Life by delivering high straight-through new business processing rates. Customers will now be able to receive a personalised insurance quote instantly, reflecting their health and lifestyle and getting their cover in place faster than ever before. The online Direct-to-consumer channel provides an alternative outlet for customers to buy insurance at their convenience, transforming the buying process.

Rakesh Kaul, Director of Business Development in Asia and Australia, UnderwriteMe, added,

“We are excited to work with Singapore Life to deliver the same high instant decision rates for protection sales that our UK clients benefit from. We share the same commitment to harness the power of modern, digital technology to meet the needs of customers and give them a fast, rewarding buying experience.”

Walter de Oude, Chief Executive Officer, Singapore Life, added,

“Using UnderwriteMe technology means that most Singapore Life customers will be able to get up to SGD2m in life insurance without the need for a medical test – with smart technology used again to create efficiency for our customers.”

UnderwriteMe has seen significant success in the UK, with 10 life insurers using its technology and reporting a high satisfaction rate according to the 2016 NMG Global Life & Health Reinsurance Study, and recently announced its first partnerships in Asia and Australia. King concluded,

“The Asia insurance industry is ripe for change and we are confident that this partnership will re-energise the market, bringing the buying process into the digital age.”