October 1, 2018

New survey highlights 60% of advisers are ready for October IDD deadline

UnderwriteMe has released the results of a survey among 101 advisers and mortgage brokers who sell protection insurance, which highlights that three in five (60%) are ready for the Insurance Distribution Directive (IDD) deadline of 1st October 2018.

Phil Jeynes, Head of Sales & Marketing at UnderwriteMe comments: “It’s reassuring to see three out of five (60%) of the advisers and brokers we surveyed say they are aware of the new IDD requirements and are fully prepared, however there is still a significant number who are yet to engage with what it will mean for their business just days before it comes into force.”

The UnderwriteMe survey indicates that over 80% of advisers are already collecting health information from their clients as part of the recommendation process, although just under half admit to contacting only one or two insurer underwriting teams to assess the effect of this information on price and product suitability.

UnderwriteMe has engaged with leading law firm Pinsent Masons to seek their views on what the new regulations mean for advisers arranging protection policies for their clients. Their view is that the IDD places increased emphasis on “personal” considerations, combined with “the client’s best interest rule”, which goes beyond the high-level requirements of Principle 6, to pay due regard to its customers’ best interests.

As shown in the survey, chances are if you are an adviser, you already likely collect health information. Pinsent Masons suggest that intermediaries see IDD as a chance to revisit their approach and review it so that meets all of the updated requirements, in particular, high-level that readily available information that may affect cover and price, such as health information, is a key part of making a recommendation based on a fair and personal market analysis of available products.

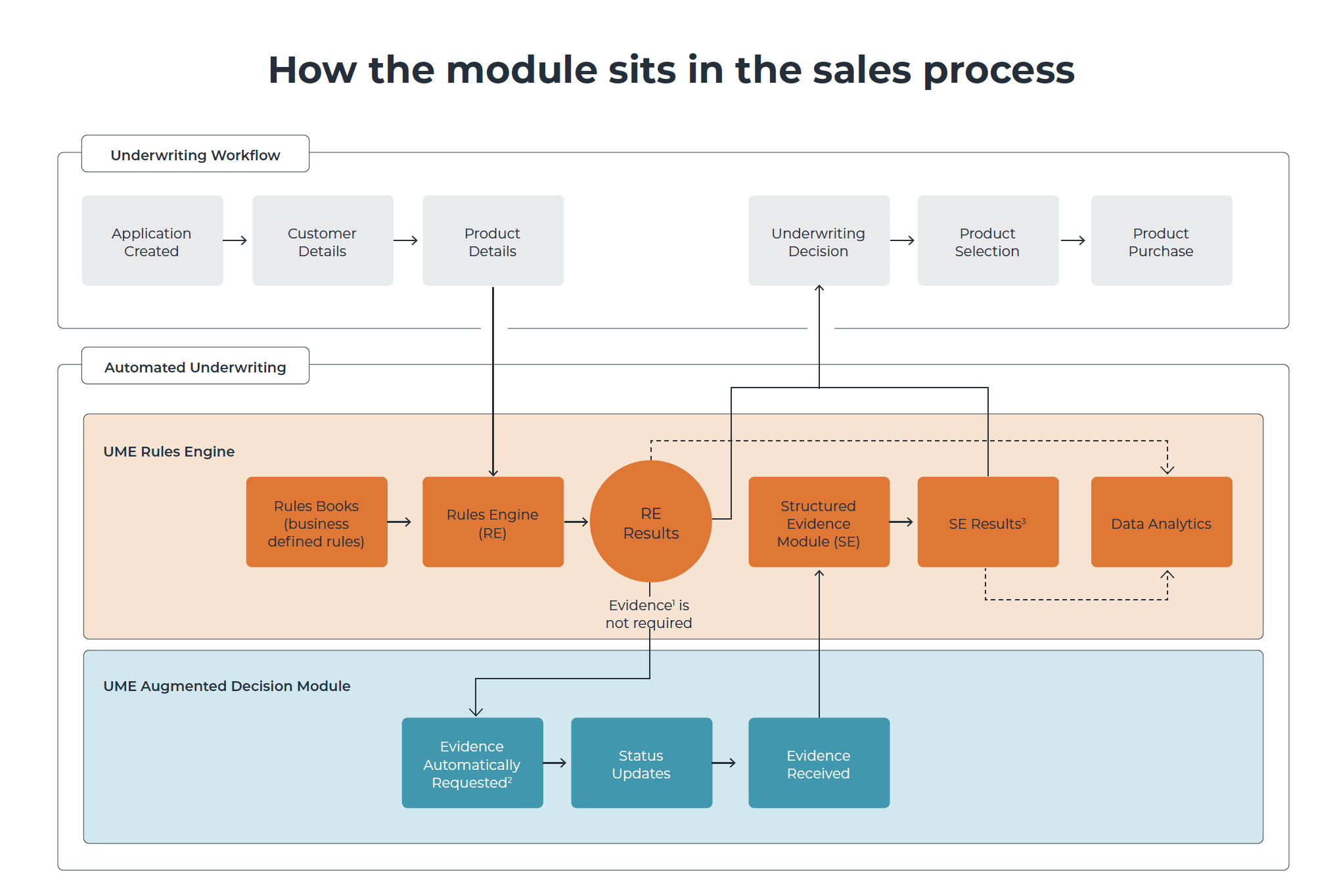

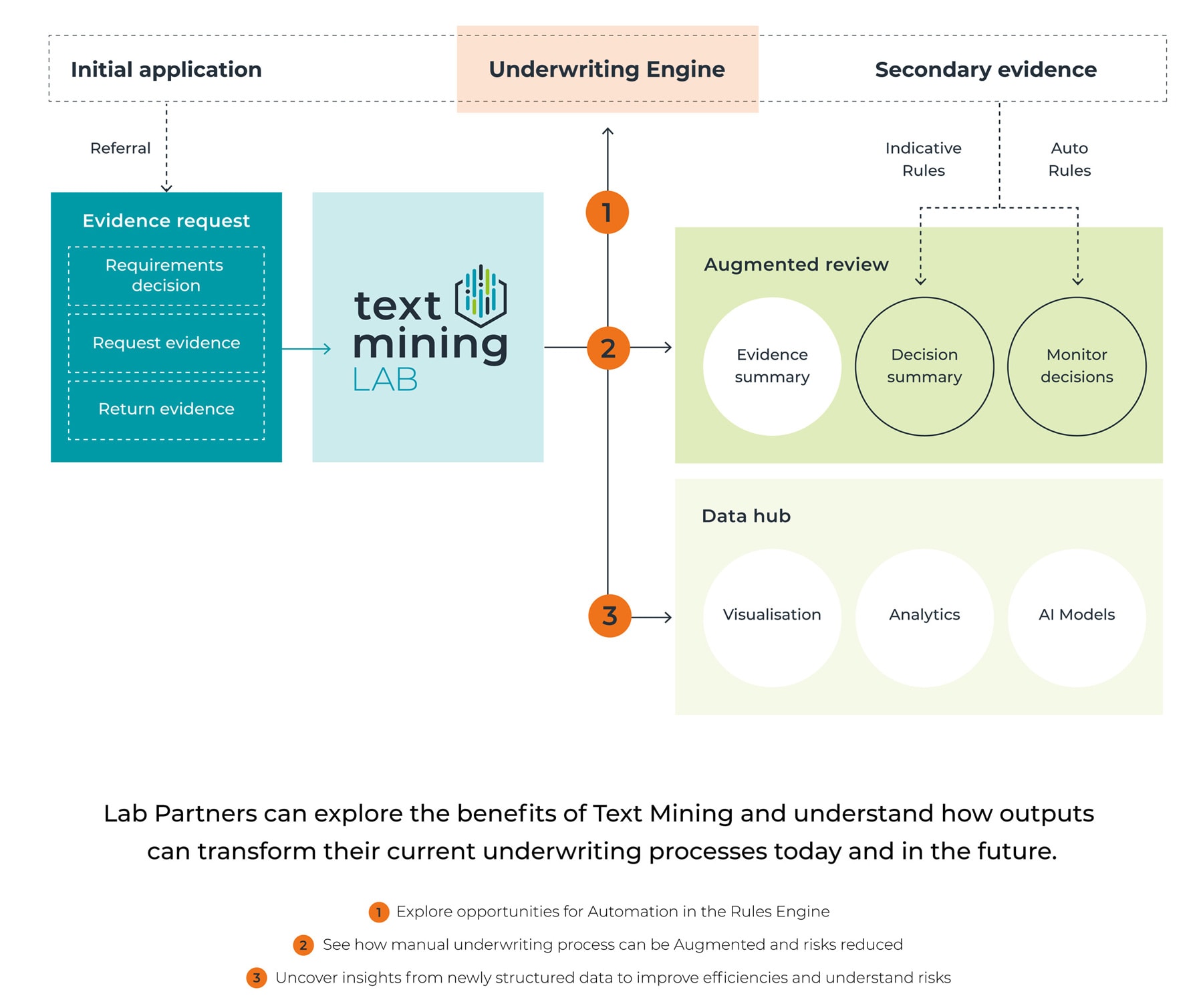

Phil comments: “Modern technology is designed to support advisers. Ringing round a small group of underwriters to gauge the effect of a health disclosure on pricing is outdated and, in the post IDD world, may be insufficient. UnderwriteMe’s Protection Platform has been specifically designed to support personal recommendations by asking the right health questions, enabling the comparison of customer specific terms and benefits across nine insurers.”

Phil concludes “Customers expect intermediaries to give information relevant to their circumstances. Health is a key factor. The Protection Platform provides a single process to obtain factual information to help intermediaries and customers make informed decisions. Our technology makes delivering a good customer service fast and easy.”