April 11, 2023

UnderwriteMe & Inuvi working together to continue transforming the Life Insurance market

UnderwriteMe continues to grow its strategic partnerships with other innovative service providers by teaming up with Inuvi, a pioneering provider of medical examinations and health services to the insurance industry.

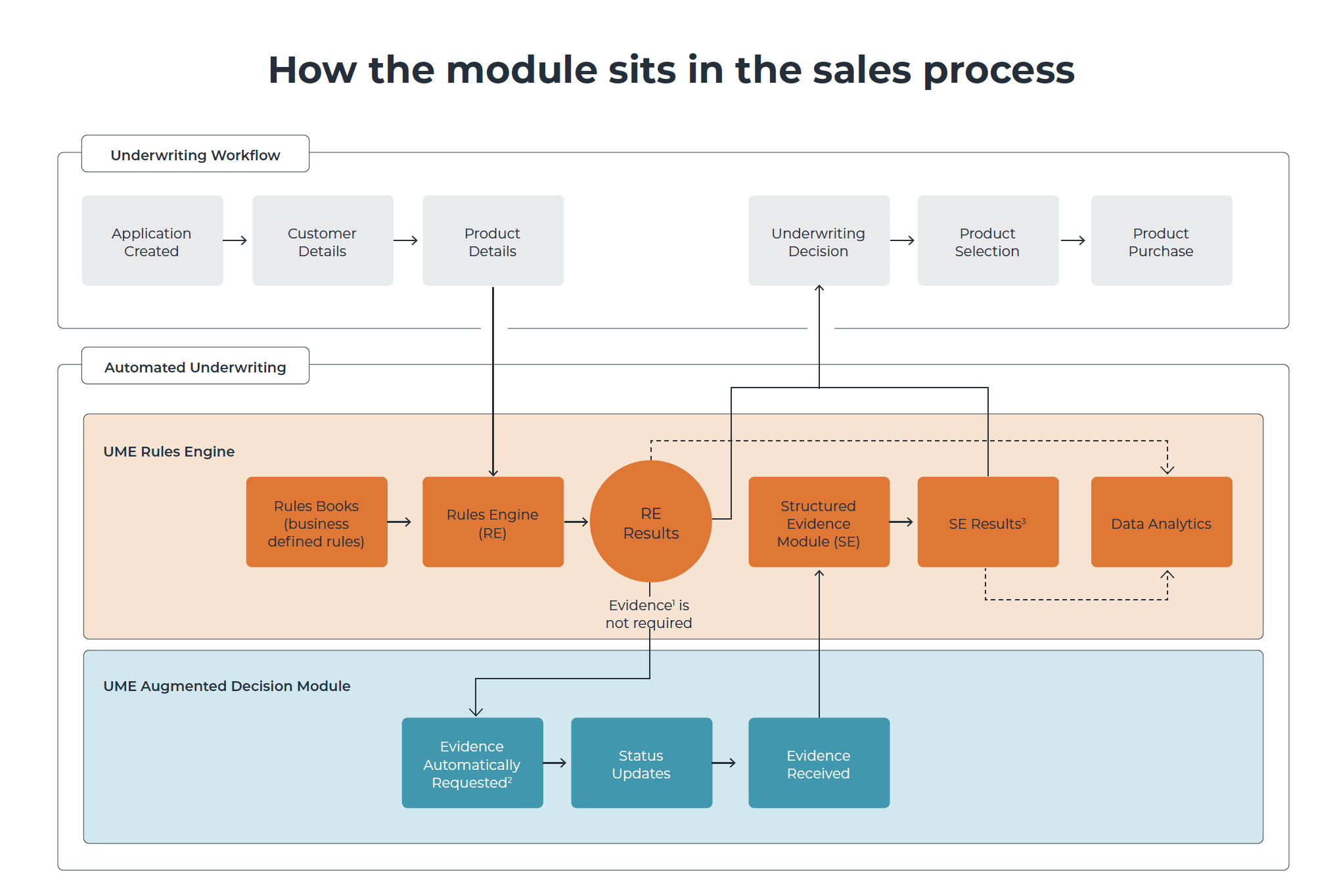

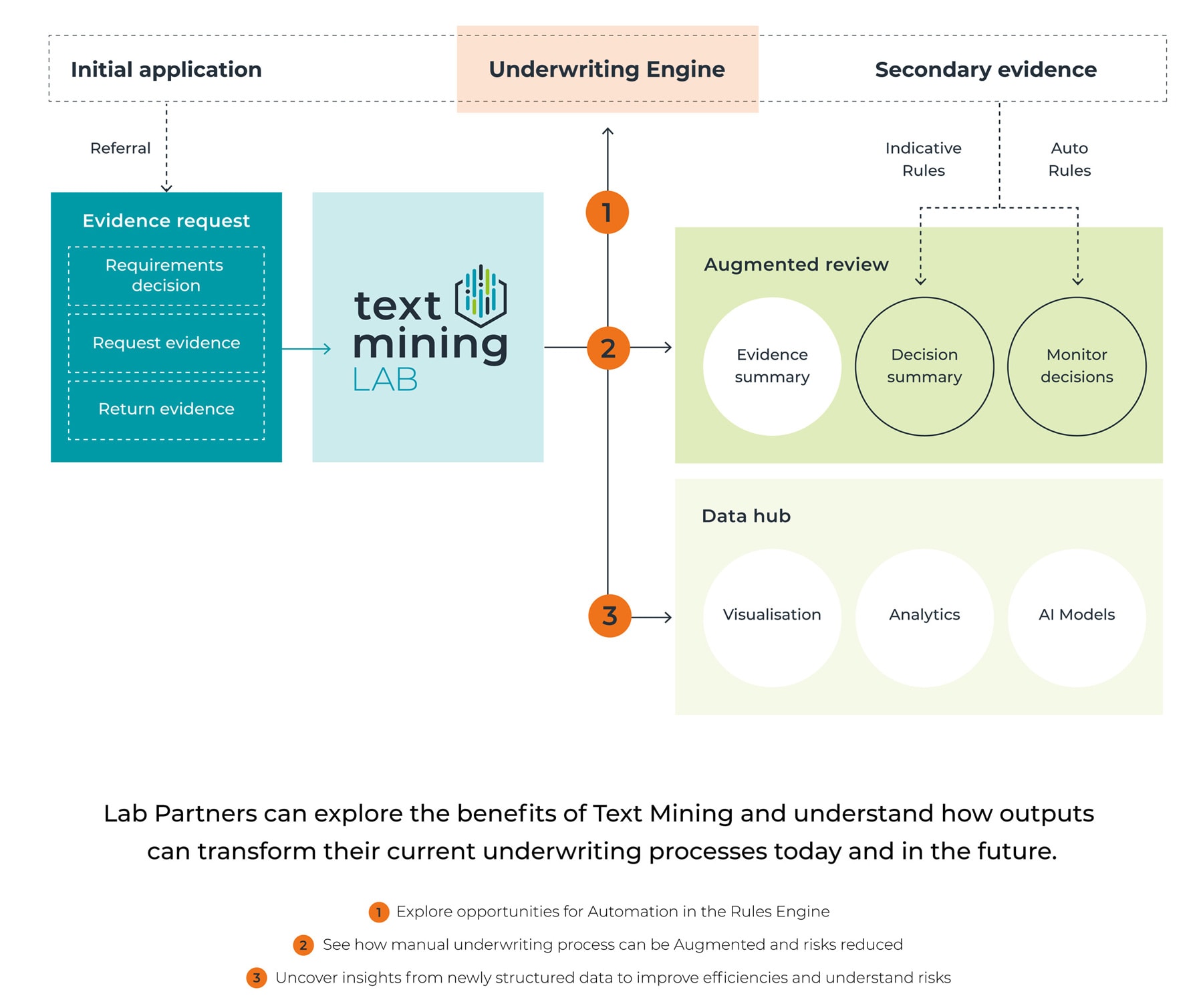

The product works by automating many of the manual processes that currently exist in underwriting and the processing of medical exams. Instead of being paper-based, and manually underwritten, they are digitally sent, received, and underwritten by the insurer without needing to go through a manual underwriter or sit in long queues waiting to be processed. This significantly speeds up the buying process for those insurers that use it, and the customers that buy products from them.

As a result of our partnership with Inuvi, both companies can now offer the product to other insurers in the market. In turn, it will make insurance more efficient, and accessible to a wider range of people.

UnderwriteMe’s Simon Jacobs, Director of Business Development, said: “As a result of our partnership with Inuvi, we are able to provide more cover, to more customers, more quickly.”

Commenting on its partnership with UnderwriteMe, Inuvi’s Managing Director, Richard Allison said: “For over a decade we have seen UnderwriteMe transforming the protection life insurance industry through technology by bringing insurers, advisers and customers closer together. From booking and managing medical examinations, to analysing test samples at our state-of-the-art laboratory, we are proud of our reputation for high quality service & innovation and providing speedy health assessments, data and insight. Inuvi is delighted to partner with UnderwriteMe to deliver this integrated technology and further efficiencies to our clients too.

Smartly integrating with UnderwriteMe’s digital underwriting engine allows Inuvi to provide our insurance clients with the structured health data they need at even greater speed. Further reducing the time it takes to underwrite customer policies, improving the overall customer and intermediary experience.”