February 4, 2019

New Ireland Assurance chooses UnderwriteMe

Insurance technology specialist, UnderwriteMe, announced today that it will be partnering with New Ireland Assurance to transform the insurer’s application process.

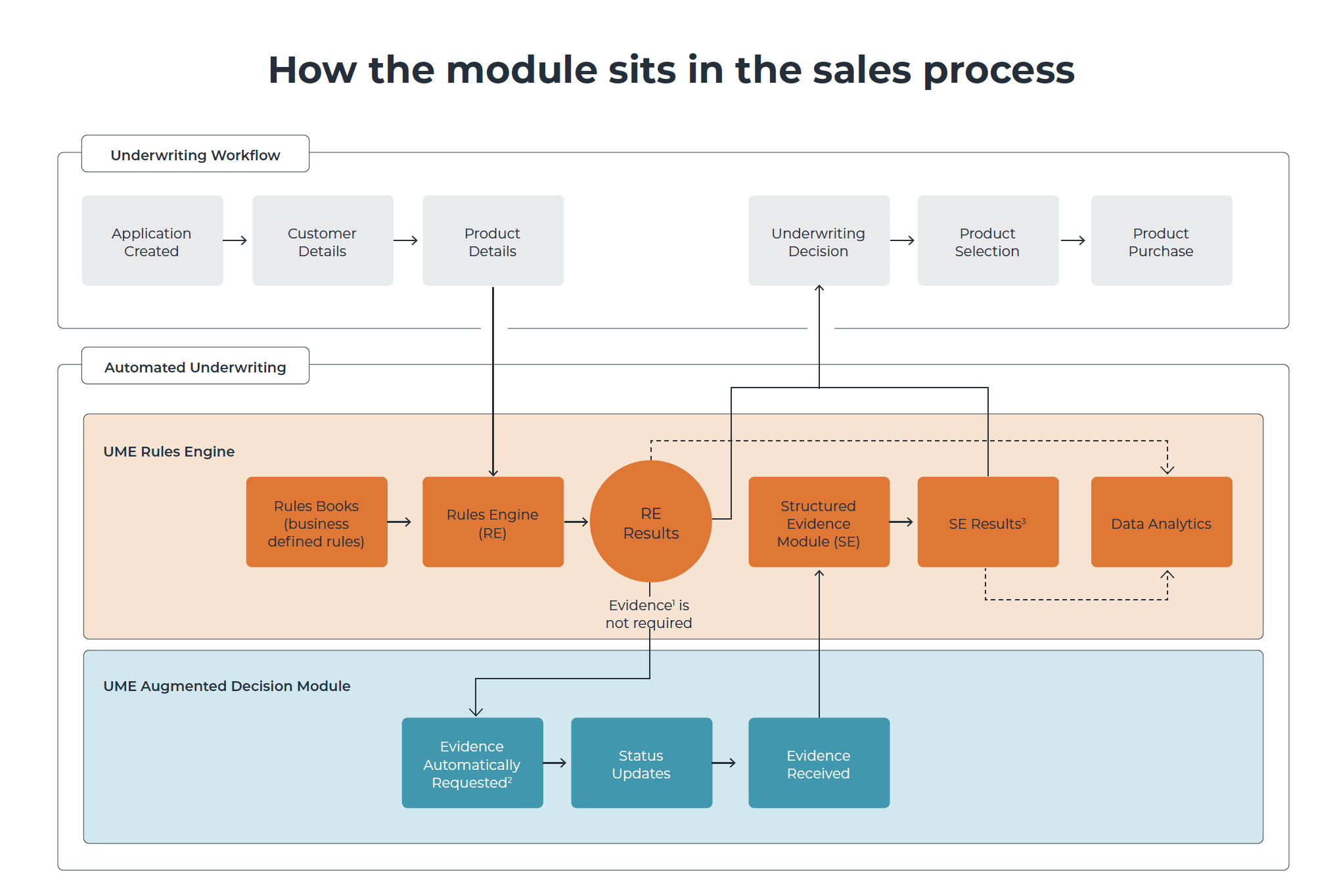

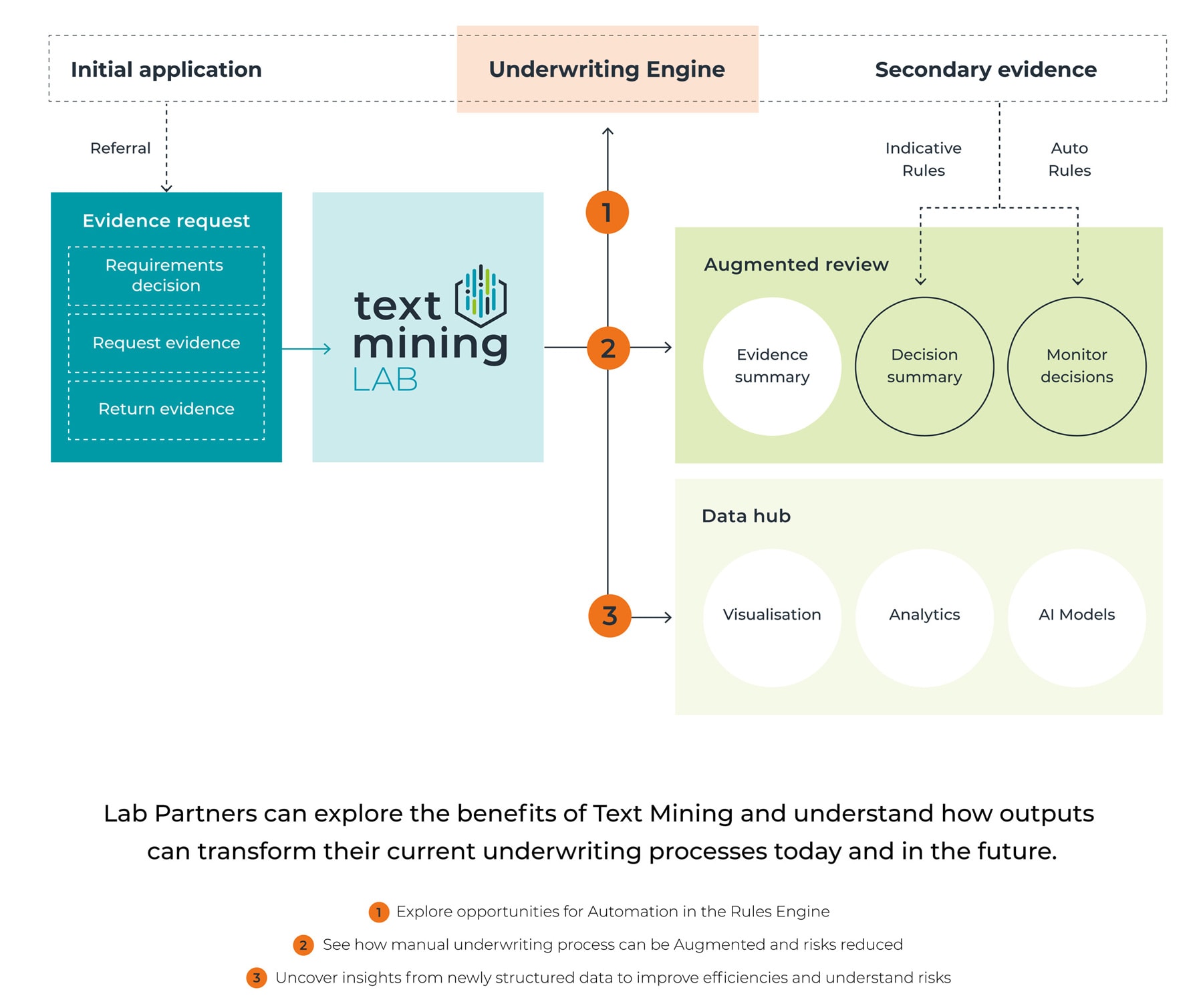

UnderwriteMe’s Underwriting Rules Engine (URE) simplifies the buying and selling process and New Ireland Assurance will use the engine to streamline processes and significantly increase straight-through acceptance rates.

The URE has been designed by underwriters for underwriters and the rules set, developed with UnderwriteMe’s parent company, Pacific Life Re, uses a database in excess of 600 rules covering more than 6,500 medical conditions. It is aligned with current underwriting practices and is the leading engine in the UK and Ireland by sales and use.

It provides real-time feedback and reporting, allowing underwriters to modify or create new rules with the latest insight. No coding or IT support is required to make changes providing the opportunity for continuous improvements in underwriting outcomes for customers.

Phil Jeynes, Head of Sales & Marketing for UnderwriteMe comments: “New Ireland Assurance is the third company in Ireland to choose our URE, bringing the number of firms in the UK and Ireland that use the technology to nine. As more life insurance firms realise the huge sales potential offered by smart technology like this, I’m certain demand will continue to increase around the globe.”

James Tait, Head of Protection for Pacific Life Re comments: “We’ve worked with, and supported, New Ireland Assurance for a number of years and I’m delighted that we are extending that partnership with the adoption of UnderwriteMe’s technology.”