October 5, 2023

It’s a mental health insurance underwriting turning point. Data shows we’re breaking the stigma

The speed of development of underwriting philosophies around mental health has been much slower than that of physical health practices. Perhaps this has added to the stigma attached to conversations around mental health for many decades. But we’re now seeing things change. The protection industry is finally giving the development of mental health underwriting the attention it’s previously lacked.

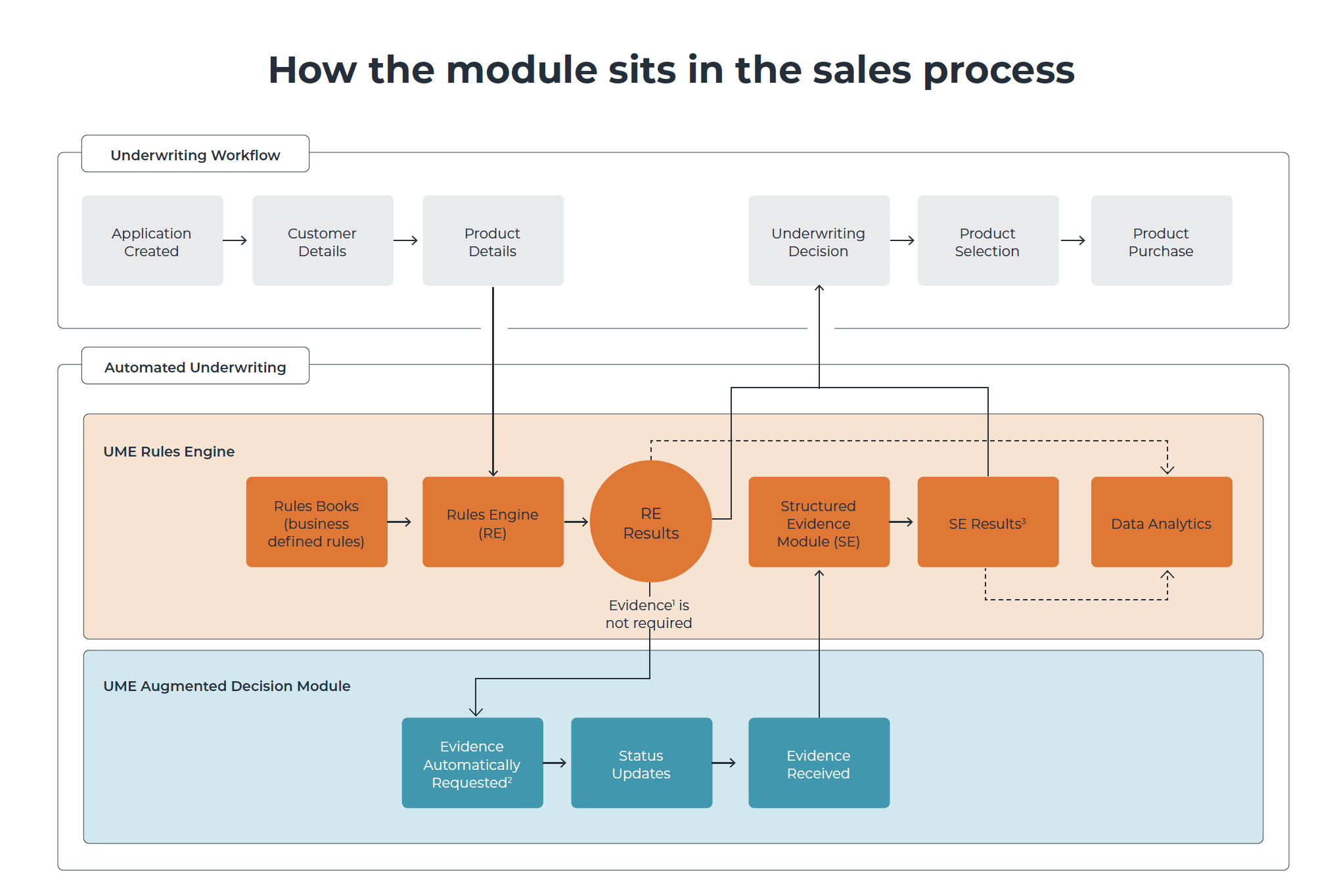

In February 2020, UnderwriteMe made a pivotal adjustment to its underwriting engine’s question sets. Interestingly, we brought in this adjustment just before the onset of the Covid-19 pandemic and later lockdowns. The isolation experienced during these lockdowns probably did more to force individuals, companies and even nations to think deeper about their own mental health, that of their employees and of their citizens than at any time before.

As we came out of the lockdowns, that greater awareness and appreciation of how to help people with their mental health at a personal, corporate and national level, highlights how important that change we made to our question set was, even though we may not have realised it at the time. The data we now possess due to these changes is not only intriguing but also reassuring.

Let’s consider a little historical context first.

Mental health conditions come in a variety of forms from anxiety, stress or depression, eating disorders, bipolar disorder to schizophrenia. But until recently, as an industry, our questions about mental health have appeared almost supplementary to questions about physical conditions. And lumping many mental health conditions into a catch all style of question hindered the development of more nuanced underwriting approaches.

For example, we know that a certain amount of stress or anxiety created by everyday life is perfectly natural and a protection provider wouldn’t be concerned with these. But by including these terms in a catch all questions, or being vague as to their true meaning, we haven’t helped ease the stigma that surrounds mental health.

It can create confusion for advisers and their clients, for example.

“I feel anxious every time I board an aeroplane. Do I have to disclose that on my life insurance application?”

“My company’s just been through a huge product launch. It’s been successful but we’re all feeling under a great amount of stress. Would that affect the price of my income protection policy?”

In contrast, we’ve seen the continuous refinement of underwriting questions and philosophies for physical conditions like hypertension, diabetes, and cancer over the last few decades. The accumulation of data drove this progress and the consequent improvement of decision-making processes. Mental health underwriting, on the other hand, faced challenges due to the many complex conditions and the reluctance of individuals to disclose their mental health issues because of the associated stigma.

With the help of our partners, we introduced completely separate question sets for physical and mental conditions in February 2020. Since the changes the results have been interesting and show that insurance is still accessible for those experiencing mental health conditions.

At a high level, we can see that despite the stigma attached to mental health conditions they are increasingly not a barrier for people being able to buy protection insurance, so cover is more accessible for more people. In addition, more people are getting a buy now or standard decision than before. If this trend continues, and we’re sure it will, then this will help to reduce the stigma about mental health when applying for insurance. Advisers and their clients can see that the answers to these new questions are helping more people get cover and aren’t being used against them.

In more detail, here’s a few statistics drawn from comparing pre and post question change data. We asked adviser Emma from Cover My Bubble to give us her thoughts on the results.

Over the past 18 months, we’ve seen the number of standard decisions given for anxiety, depression and stress has increased from 80.11% to 89.38%

Emma says, “The system is accepting more clients with an instant decision or rating/exclusion. We are seeing an increase in mental health disclosures for both male and female clients along with more disclosures of self-harm and attempt history. When we initially speak with clients, we take the information and history or any medication and the pre-underwriting to get the best outcome for our clients. We will let them know why we are taking this information as it reassures them that we are doing are best for them, especially if they have been let down previously. They are giving us very details history that could be triggering for them, so it’s important to handle with care and reassurance to give them a better journey. This way they know what the outcome is going to be before proceeding with an application, so when it does drive a rated decision or refer, they know why, and I keep them in the loop.”

We’ve also seen the number of customers receiving a buy now decision has increased from 86.96% to 94.56%

Emma praises insurers who have, “Worked so hard to get quicker decisions and that’s such a great outcome for our clients. Its saving so much time for everyone. And were finding people who have struggled before because a “computer said no”, are now getting covered.

Of those aged under the age of 40 and disclosing a severe mental health condition such as bipolar disorder, an eating disorder, manic depression, schizophrenia, or psychosis 73% were female.

Emma agrees and says that “Many of our clients are under the age of 40 and we are seeing more mental health disclosures of this kind. I think these stats are due to mostly women wanting to contact us to arrange their insurance as we do speak to more women than men although that again is in the increase which is good to see.”

Steve Baldry, our Director of Underwriting had this to say about the latest data. “In 2020, we expanded the mental health application form questions to a broader range of conditions that included anxiety, bipolar disorder, self-harm and schizophrenia.

“A customer’s mental health can often be a daunting and complex issue for insurers to ask about, and for customers to disclose. We made the changes in 2020 to make the experience more personalised and easier to answer. We think that a simpler journey has resulted in more accessibility for our customers, meaning a higher level of customer disclosure, more standard terms being offered, and fewer referrals to underwriters.”

Whilst this is all incredibly positive the industry still has a great deal of work to do to make our approach to mental health as data based as it is with physical conditions. For example, the eating disorders mentioned above will almost always result in a referral. But as we gather more data, we’ll be able to refine the questions and eventually we’ll see buy now cases increase.

We’re keen to work with advisers to help more of their clients who experience mental health conditions get the cover they need. Together we can further reduce the stigma that still surrounds mental health conditions by collectively increasing our knowledge and experience, and get more people covered at the same time.

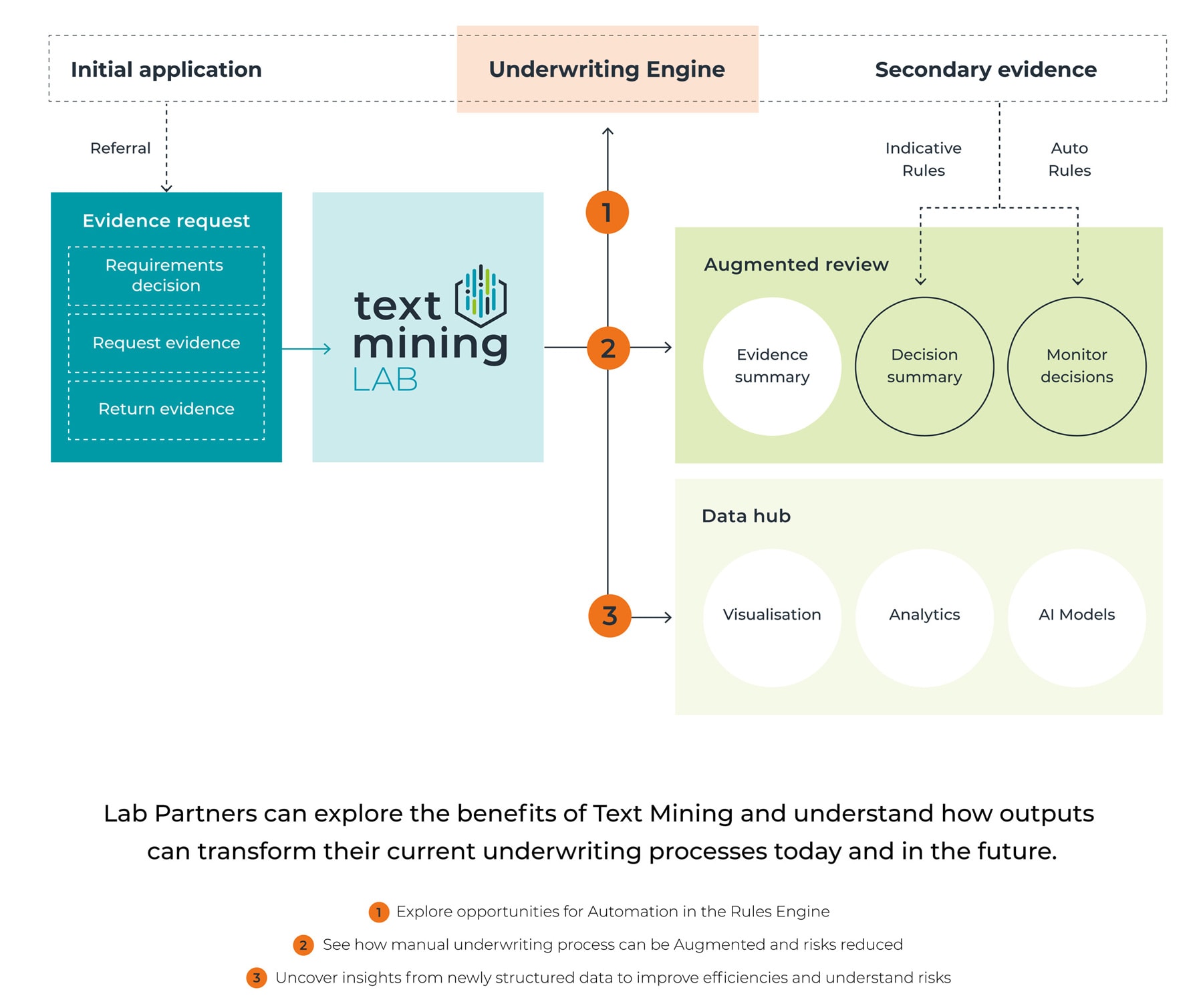

Visit our website to learn more about how we are improving the customer journey for insurers with our underwriting technology.