July 29, 2019

FWD Singapore partners with Pacific Life Re to implement UnderwriteMe technology

FWD Singapore (“FWD”) has adopted a new solution that enhances the digital insurer’s real-time risk assessment on policy applications and delivers improved underwriting decisions for their customers.

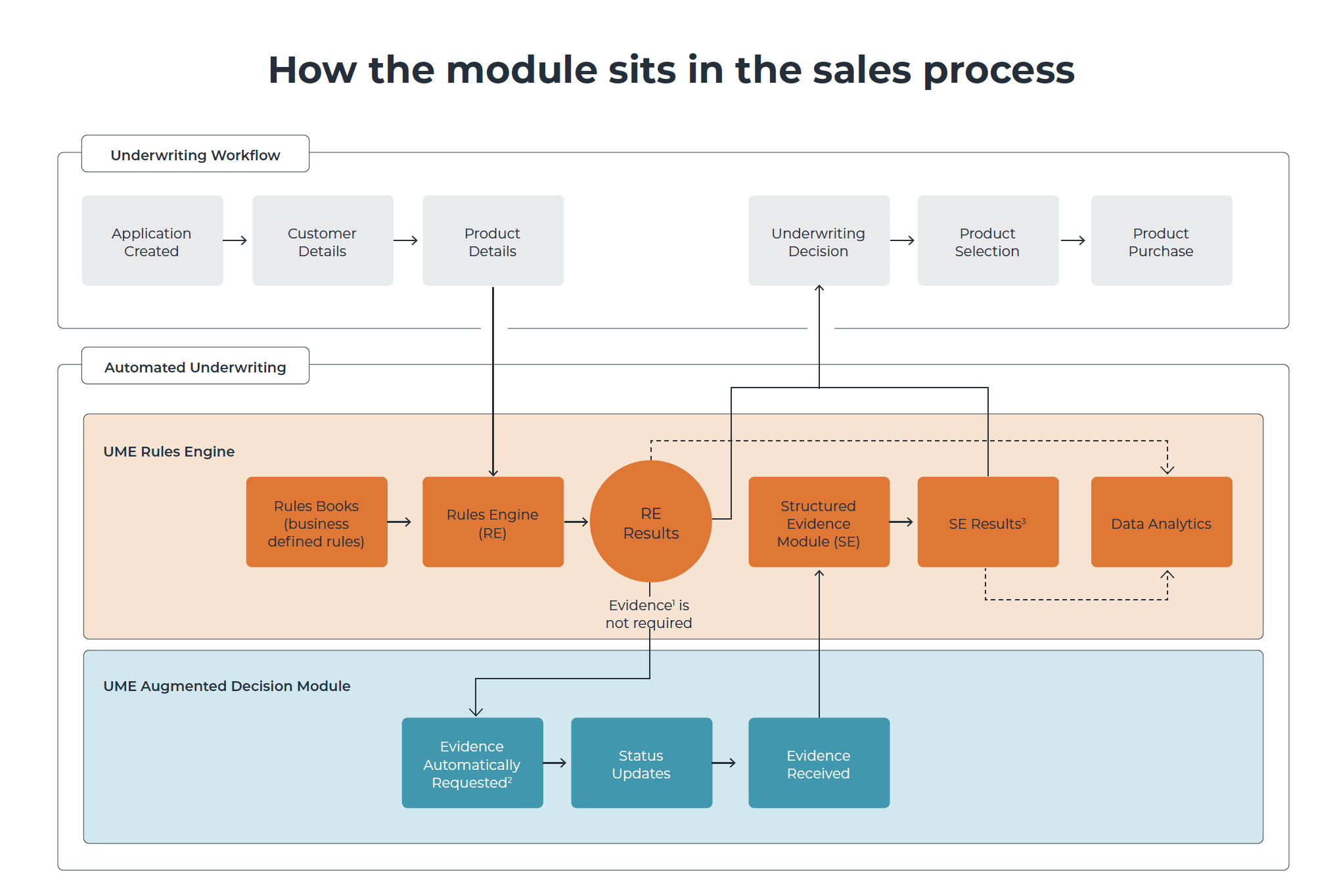

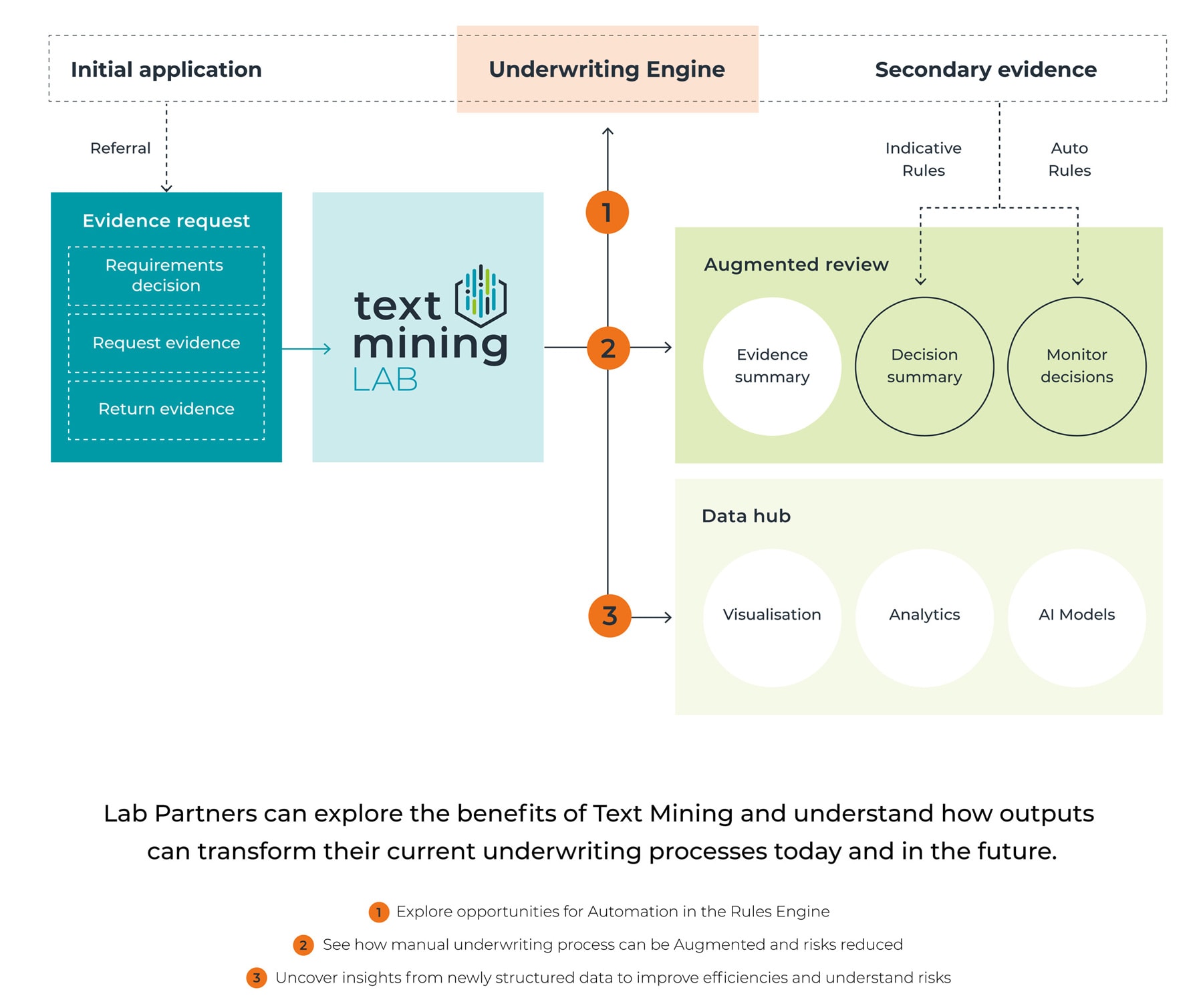

This new digital solution, which is built on the Underwriting Rules Engine (URE), is powered by UnderwriteMe, Pacific Life Re’s fully-owned subsidiary. It incorporates Pacific Life Re’s slick underwriting philosophy and has enabled FWD to tailor its underwriting approach for its customers. The URE is expected to drive significant efficiencies for FWD by delivering high straight-through new business processing rates, with customers receiving a personalised underwriting decision instantaneously.

This digital solution will be used to assess applications for FWD’s existing direct term life products.

With the collaboration, FWD joins a growing list of swift implementations by UnderwriteMe in Asia.

Rakesh Kaul, Director of Business Development for UnderwriteMe, commented, “Both teams worked

in an iterative and collaborative way, which resulted in the project being delivered within months. We are pleased to have worked with FWD to provide a quick to market solution to improve the quality of service and experience for their customers.”

Andrew Gill, Managing Director of Asia & Australia, Pacific Life Re, added, “FWD is known for its cutting edge, digital strategies, and we are thrilled to be working alongside them to make it simpler for customers to purchase insurance through harnessing the power of modern, digital technology.”

Abhishek Bhatia, CEO of FWD Singapore, described the partnership with UnderwriteMe as yet another demonstration of how the company uses technology to simplify the process of buying insurance products.

He added, “What customers need and look for when searching for suitable insurance solutions is a fuss-free experience that is not bogged down by complicated processes. With UnderwriteMe, we can offer that and continue to change the way people feel about insurance.”

Plans to extend this digital solution to other FWD locations in Asia over the next 12 months are underway.