Thank you for choosing the Protection Platform. Here you will find eveything you need to know about the using our platform, whether you’re new and looking to onboard or you’re a seasoned user and simply have some technical queries.

Use our handy navigation below to find what you need help with.

Getting set up

How to register

Registration with the protection Platform is simple this document with highlight the steps required to receive your login details.

We are a little bit different; our set up relies on providing your agency codes to accurately replicate the customer premiums and adviser commissions. The quickest way to get your login details is to provide your insurer agency codes. In addition to your contact and firm details we will need agency details from each insurer you have terms with.

Registration FAQs

What information will I need to register?

To set your account up we need to take some information from you.

- Fill in the registration form by providing your individual details, company information and (if available) agency codes

- We then register your company and all advisers that require access

What if I don’t know my agency codes?

Please make sure you are set up with the relevant insurers prior to completing this form.

If you select this option, we will retrieve the relevant information from all insurers selected, please note this will take up to two weeks to complete.

Please beware we are not able to set you up with any insurer provider, there must be an existing agency set up in place.

How can I register more than one adviser?

You will need to provide agency information for each adviser you would like to register on the Platform.

How long does it take to become registered?

You will need to provide agency information for each adviser you would like to register on the Platform.

Creating an application

Protection Platform Terminology

What does ‘Buy-Now’ mean?

Buy-Now means that the case has been accepted at standard rates and you can place this policy on risk immediately. There is also the ability to submit with a future start date with the ‘to be confirmed’ option.

What does ‘Buy-Now Non-Standard’ mean?

Buy-Now Non-Standard means that the case has been accepted at non-standard terms. You can still Check the ‘Details’ tab to see the decision information outcome. You can submit or place this policy on risk immediately. There is also the option to submit with a future start date.

What does ‘Referred’ mean?

The insurer would like to review the application before finalising terms. You can complete the application through the Protection Platform and the insurer/s will complete the further steps.

What does ‘Evidence required’ mean?

The insurer requires evidence before they can put this policy on risk. You can check the details tab to see what evidence is required. You can complete the application through the Protection Platform and the insurer will complete the further steps.

What does ‘Unable to offer cover right now’ mean?

Unfortunately, the insurer/s cannot offer cover to your customer(s) at this time. This would be a postponed application. Check the details tab. for more information on why and timescales.

What does ‘Unable to offer cover’ mean?

Unfortunately, the insurer can’t offer cover to your client(s). This would be a declined application.

What does ‘Outside product limits’ mean?

You haven't met the insurer/s criteria in your product request or underwriting limits. A couple of examples would be quoting a feature that an insurer doesn’t offer or requesting an expiry age that sits outside of the insurer/s threshold.

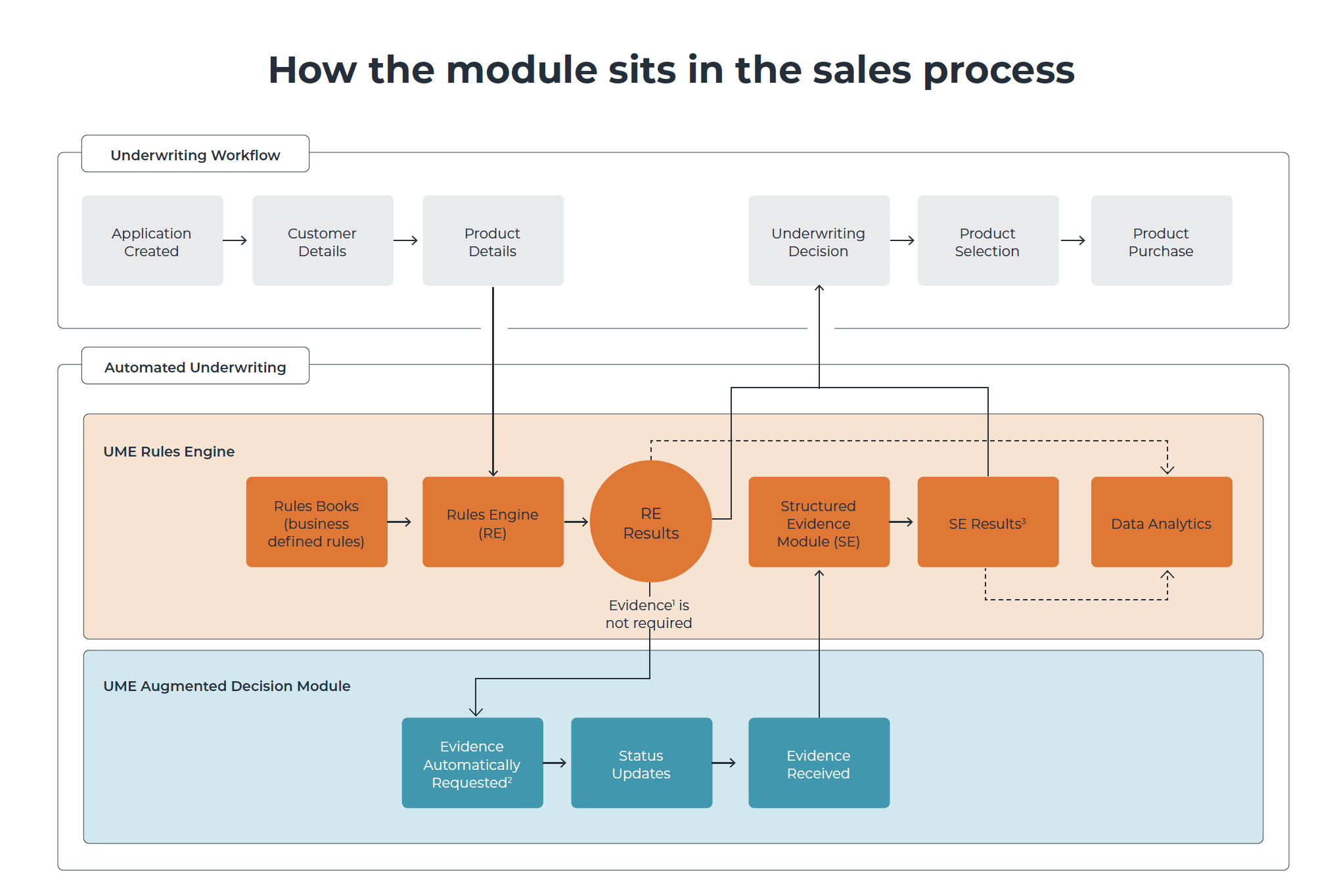

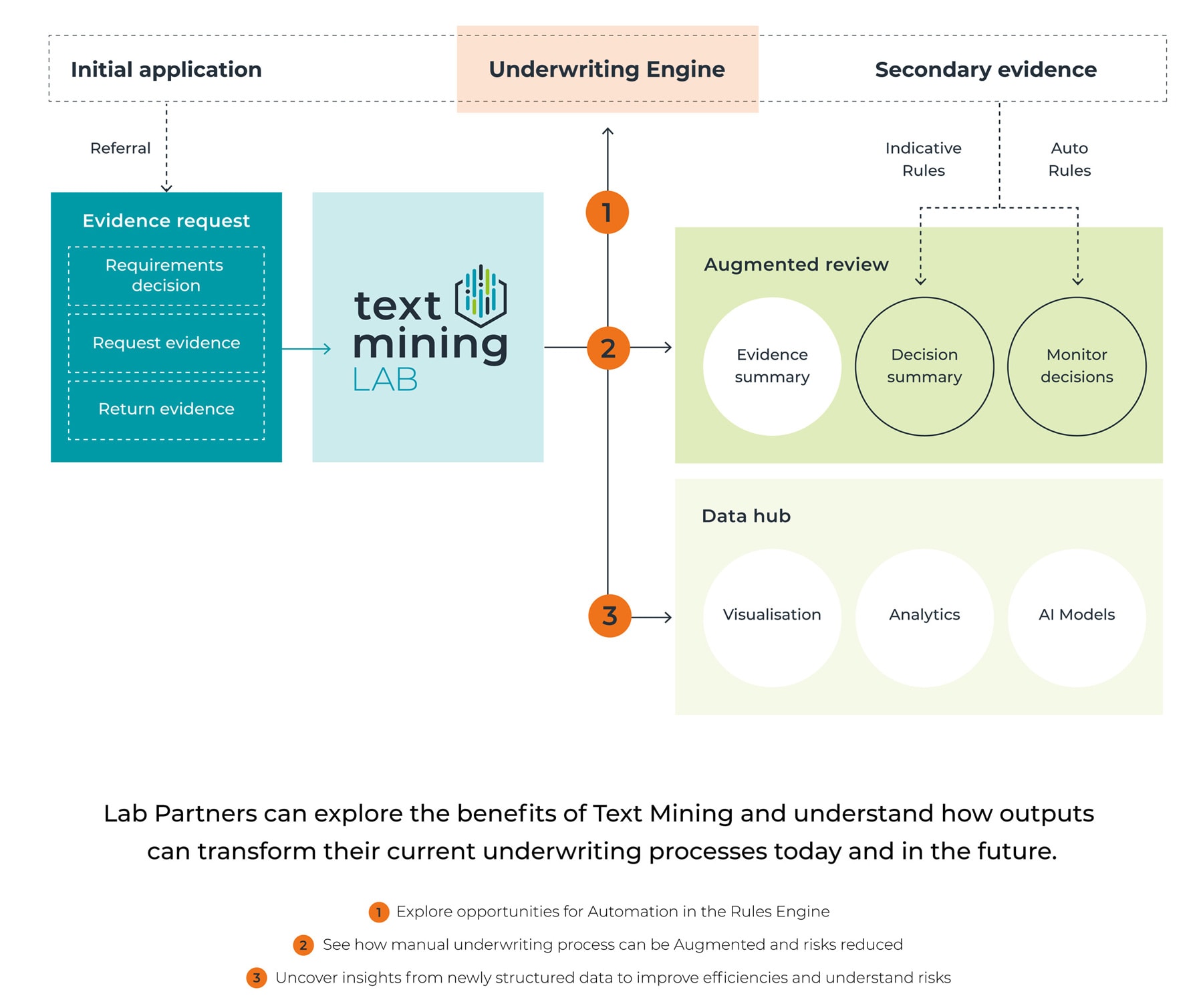

What does ‘Automated Referral’ mean?

Automated referral uses our technology to issue, receive and process blood tests and medical screening reports to provide straight through decisions. This is all dealt with through the protection platform, rather than the insurer directly.

What does Activated mean?

Activated on the protection platform simply means the case has been submitted to the insurer. This could be for standard/non-standard cases or cases that require further underwriting.

Multiple Applications

How do I add multiple products to the application?

Once the personal details have been captured you will be taken to the next page where you will be able to select from 5 different products. Simply select the product, complete the needed information on the page, and select “Yes” to add another product. You can see all products selected on the left hand side of the Platform.

Where do I add different insurers to the basket total?

You will see all products selected at the top of the result screen. Once the client has decided which provider to choose, simply select the provider by hitting the “Buy Now” button, this will be added to the basket total at the top. Repeat this process for each person/ product selected.

Do the multiple app functions include multi-policy discounts?

Yes, if the provider offers the multi-policy discount, you will see the discount included in your basket total once all needed products have been selected.

How do I track the submission of multiple applications?

Post submission updates will always sit with the provider and can be tracked in the same way as a single submission, if you have multi providers selected, please contact each provider for the needed policy updates.

Can I review the date/time on previously submitted applications via the platform?

Yes, if you click through to the activated case you will be taken to the summary screen, this will show you the activation timestamp for each product in the application.

How long is the review document available on the Platform?

This information will be available for 180 days on the Platform, after which please contact the provider or alternatively you can raise a ticket support team for confirmation (support@underwriteme.co.uk).

Do I need to complete more than one client declaration for multi apps?

This depends on the number of providers selected, if you have multiple providers selected each provider will have their own client declaration to complete.

Do I input more than one set of bank details for multi apps submissions?

No, you only need to input one set of banking details for multiple applications and insurers.

Will my client get one direct debit?

Not necessarily as this is provider specific. If you have selected different insurers each insurer will collect their own premium/s .

Defaqto

How does this feature help driver client conversations?

Using Defaqto enables Advisers to showcase different provider products and key features versus competitor offerings. The Defaqto Compare comparison tool helps drive client conversions and customer retention – it facilitates instant provider and product identification which allows advisers to have factual conversations with clients whilst discussing the various provider USPs.

Once I’m at the result screen how do I select the provider I’d like to compare against?

There are small squares on the right-hand side, allowing you to select 3 providers at a time. Once the providers are selected scroll to the bottom of the page and click on the button “Defaqto compare” this will then generate the report for you.

How do I compare products and features within the report?

Simply select the question mark icon and further information will drop down. There is a variety of information to choose from, additional wellbeing features, children’s conditions, number of CI conditions and more.

Will I have access to the ABI and Non-ABI condition list?

Yes, this is available when selecting a critical illness product to your application. The ABI & Non-ABI list can be found right at the top, just underneath the star ratings .

Can Defaqto compare retrospective conditions?

No - Defaqto compares the current provider product and features as they are today, this does not include retrospective conditions. This information however can be sourced directly from the provider extranet.

Is there a report I can download and send to my client?

Yes – if you click the “print” icon at the top you will be able to print the document or convert into a PDF document.

Utilising the platform

Direct Debits FAQs

Can I submit without the sort code and account number?

No, all applications must have the client's correct sort code and account number prior to placing the application on risk or submitting it to the insurer.

Can I use a different set of direct debit details to the name on the application (family member)?

The name on the direct debit must match one of the lives (life) on the application.

What happens if I have more than one product that requires a different start date or has different underwriting decisions?

You can place different start dates to coincide with the underwriting decisions or client circumstances. The Protection Platform will allow you to input different start dates to fit with the client's criteria. Although, if you are selecting the same insurer for all products, only one start date option is provided.

When will my client's premium be taken?

You have the option to provide a preferred premium collection date within the direct debit stage. The Protection Platform does not impact the way insurers collect premiums.

Online Trusts

Online trusts are not available on the Protection Platform, however, you are still able to submit a policy via the protection platform and the trust directly with the insurer (either paper-based or online). Different providers do have their own process regarding the completion of trusts, please see the below guide for more information.

Underwriting FAQs

Underwriting FAQs

What do I disclose if my customer smokes on an occasional basis?

If your customer has smoked in the last 12 months then you will need to disclose them as a smoker, as seen in the help-text.

What do I disclose if my customer vapes or uses other tobacco related products?

If your customer has vaped or used other tobacco related products in the last 12 months then you will need to disclose them as a smoker, as seen in the help-text.

When I need to make multiple edits, how can I stop being taken to the results screen after every edit?

When you go back into the application, once you’ve made the relevant edit you can select the ‘Section’ sidebar (see screenshot) to navigate around the application in any order you wish, rather than selecting ‘Next’. Once you’ve done your final edit, select NEXT to take you back to the results screen.

What if the medical disclosure I’m trying to make isn’t showing in the typeahead search?

When you’re making a disclosure and it’s not showing in the typeahead search, it may be because the spelling is incorrect or potentially a rare condition that isn’t in the UnderwriteMe list of ‘conditions’.

Post-sales FAQs

Post Submission outcomes

What happens next when I press ‘Accept and Submit’?

If I put in a start date:

The plan will commence on the date entered.

If I put ‘to be confirmed’:

Once submitted through the protection platform, you must contact the insurer directly to place the policy on risk.

If the application requires further underwriting

All underwriting updates are provided directly by the insurer via their usual process.

I cannot see the LV and Scottish Widows policy numbers when I submit

Neither insurer can provide their policy numbers post submission/activation, they will contact the adviser directly.

Where does my client's information go after leaving the platform?

All client information is sent directly to the insurers immediately after submitting/activating the application.

Compliance

How does the Protection Platform support compliance?

Each Protection Platform application has an important documents folder which contains 3 important documents.

The client’s health and lifestyle questions

This is a PDF record of the application. All answers are date and time stamped, giving you an accurate record of answers provided by your client – particularly important if they change their mind.

Comparison document

This document shows the results, after taking into account underwriting disclosures. Saved as a PDF, this document is perfect to share with your client if they wish to look at all life insurance and pricing options available to them. Please be aware this document will no longer be available once you have submitted your application through the Protection Platform.

Quote illustration

The quote illustration is a PDF of the prices offered to you at the end of the application and is useful to share with your client and/or keep for your record.

Commission & Costs

How much does the Protection Platform cost?

The Protection Platform is free to use with no change in how you receive commission or on the insurer’s premiums.

How is my commission calculated?

Your commission is calculated via your agency code and the agreement you have reached with each provider/insurer.

What if I am a one-adviser firm?

We reflect any rates you have agreed with the provider.

How does my commission get paid?

Your commission gets paid directly from the insurer.

Technical enquiries

Need to contact our Tech Support Team?

What are your support hours?

The team are available Monday to Friday 9 am – 5 pm.

Can I get someone to run a training session?

Our Account Managers are available to run training sessions for you and the team. To book a time a date and time contact us at info@underwriteme.co.uk

Need more help?

Here are some useful Protection Platform support material:

Still can’t find what you are looking for?

Fill out the contact form below and our dedicated support team will get back to you.