July 28, 2022

Guardian enhances mental health underwriting and makes changes to evidence requirements for some conditions

- Clearer mental health question set differentiates upfront between anxiety, depression, self-harm and suicidal thoughts

- Fewer evidence requirements for asthma, diabetes, hypertension and cholesterol

- New system integrates with UnderwriteMe’s underwriting rules engine

Protection challenger Guardian has today shared detail of changes to its mental health underwriting question set, along with enhancements related to asthma, diabetes, hypertension and cholesterol. The underwriting changes are designed to help support full disclosure and make it easier and faster for clients with these conditions to get a decision and be offered appropriate terms.

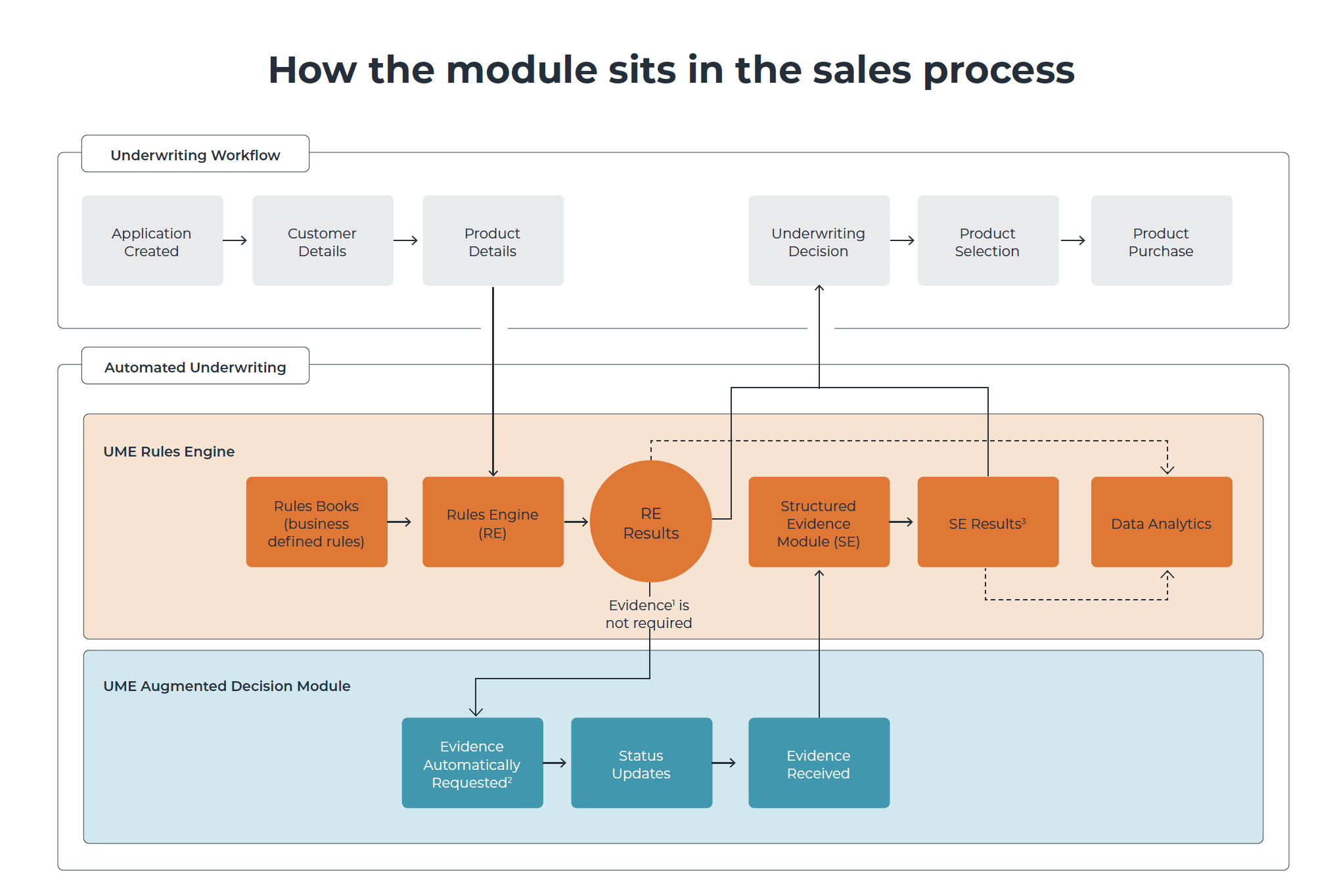

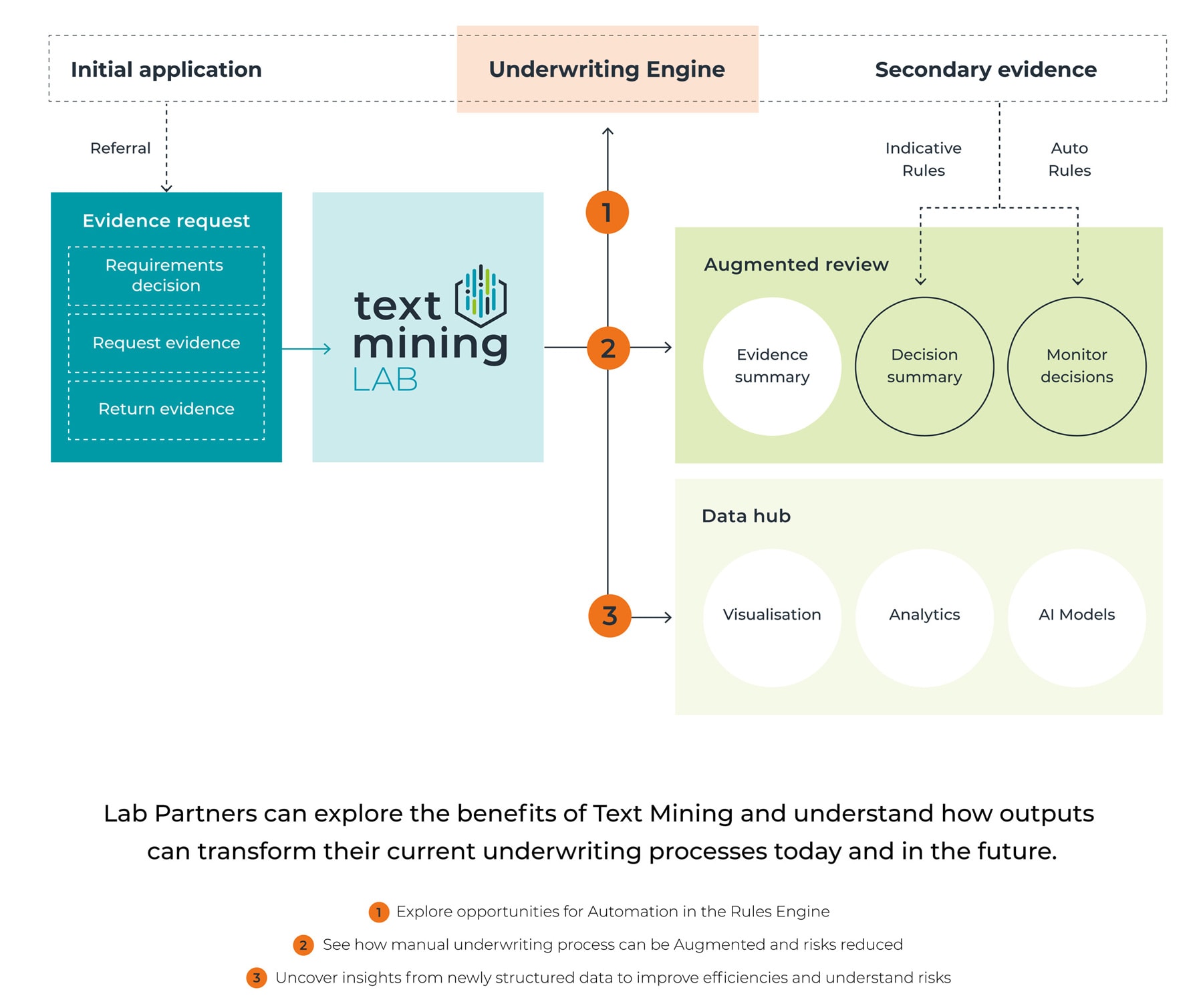

The changes form part of the upgrade to Protection Builder 2.0, Guardian’s new quote and apply system, which is integrated with UnderwriteMe’s underwriting rules engine technology. Guardian expects the underwriting changes to speed up decisions for applicants who disclose lower risk mental and physical health conditions, further improving adviser and client experience.

Guardian’s underwriting enhancements include:

- Mental health: Clearer question wording with conditions separated out in line with ABI guidelines, to differentiate between anxiety, depression, self-harm and suicidal thoughts

- Asthma: Fewer requirements for medical evidence and reduced loadings for some smokers with mild asthma

- Diabetes: Fewer evidence requirements where associated conditions are present, for example, raised cholesterol or blood pressure

- Hypertension: No automatic postponement solely due to blood pressure checks having not taken place in the previous 18 months

- Cholesterol: No longer asked if cholesterol has been checked in the last 12 months

Caroline Froude, Head of Technical Underwriting, Guardian, said: “The world’s changed and people talk about mental health very differently now. Everyone is much more open to discussing issues, both mild and serious, and so it’s right to alter our question set to account for that.

“Our new mental health question set differentiates between anxiety, depression, self-harm and suicidal thoughts, to reflect our current understanding of risk associated with the range of different mental health conditions, as well as ABI best practice. The questions help support advisers and their clients in making full and accurate disclosure, and means they’ll receive the appropriate underwriting outcome without compromising speed.

“We’ve also made changes for applications containing disclosures about asthma, diabetes, hypertension and cholesterol levels. We’ve reduced the amount of evidence required in some instances, which helps improve the application experience whilst continuing to give the adviser and their client complete certainty in their protection policy. Our ultimate aim is to make working with Guardian effortless, and these changes are designed to deliver that.”

Simon Jacobs – Business Development Director, UnderwriteMe, said: “We’re delighted to support Guardian in its aim to provide an effortless adviser experience, and are very proud that they have chosen to partner with us to provide their Underwriting Engine. We look forward to working with Guardian closely in the future to provide the best underwriting experience for customers and advisers.”

The detail of these underwriting changes follows on from Guardian’s news last week about the upgrade to its quote and apply system, Protection Builder 2.0, as well as its pre-sales underwriting tool, Qi. The self-serve tool, available to Guardian’s registered advisers via their adviser dashboard, now links to Guardian’s full underwriting question set, to give a quick and easy indication of indicative terms at the touch of a button. Advisers can register with Guardian – and gain access to the new Qi tool – via the website: https://adviser.guardian1821.co.uk/.