April 24, 2023

Automation: The solution to better insurance underwriting

Underwriting has been the backbone of the life and health insurance industry for decades. Traditionally, insurance providers have relied upon underwriters and other business resources to evaluate medical, financial and other data points to determine eligibility and pricing of products offered to customers. It’s a process that takes time, human resources, and could potentially contribute to a protection gap that’s predicted to hit over £1.3 trillion ($1.7 trillion)¹ by 2025.

But what are the roadblocks in underwriting? How can you use automation to overcome them? And how does simplifying your client experience and underwriting process through automation mitigate the risks of digital transformation in your insurance firm? Read on to find out more.

Offering life and health insurance policies to customers has never been a straightforward process. Every application is independent in nature, depending on an applicant’s current health condition and medical history. However, with the time to obtain medical records being shared by both administration teams and applicants, the process is compromised and, ultimately, the final customer may not get the protection they need.

This process is particularly time consuming for insurance providers of all sizes. For example, relying on administration teams to contact doctors and various medical professionals to obtain data, and offsetting them against policy conditions and pricing structures can range anywhere from a day to a matter of weeks. A lack of, or delay in, the response from insurance providers can seriously impede customer experience. McKinsey argues is a major source for profitable growth² within the industry, highlighted by evidence that insurers providing best in class customer experience have generated 2-4 times more new business growth and are 30% more profitable than those firms with an inconsistent customer focus.

Although the onus is on the customer to provide accurate information within an application, insurance underwriters are responsible for the review of the various data points and recorded information within the application, and ultimately, the decision making and overall outcome. While the decisions do lie with the underwriter, UnderwriteMe’s data shows that if an insurance provider can reduce the processing time of an application to less than 2 weeks, 25% more customers will purchase the cover offered.

As well as the increased risk of drop-offs during the underwriting process due to poor experience, there is a risk of further detriment to potential customers, who are likely to be frustrated by the negative outcome and subsequent lack of protection for critical illnesses and financial safety.

Speeding up the underwriting process is not impossible. In fact, it’s becoming an easier problem to overcome as digital solutions are advancing to pave the way for improved customer experience and improved drop off rates.

Making way for digital insurance solutions

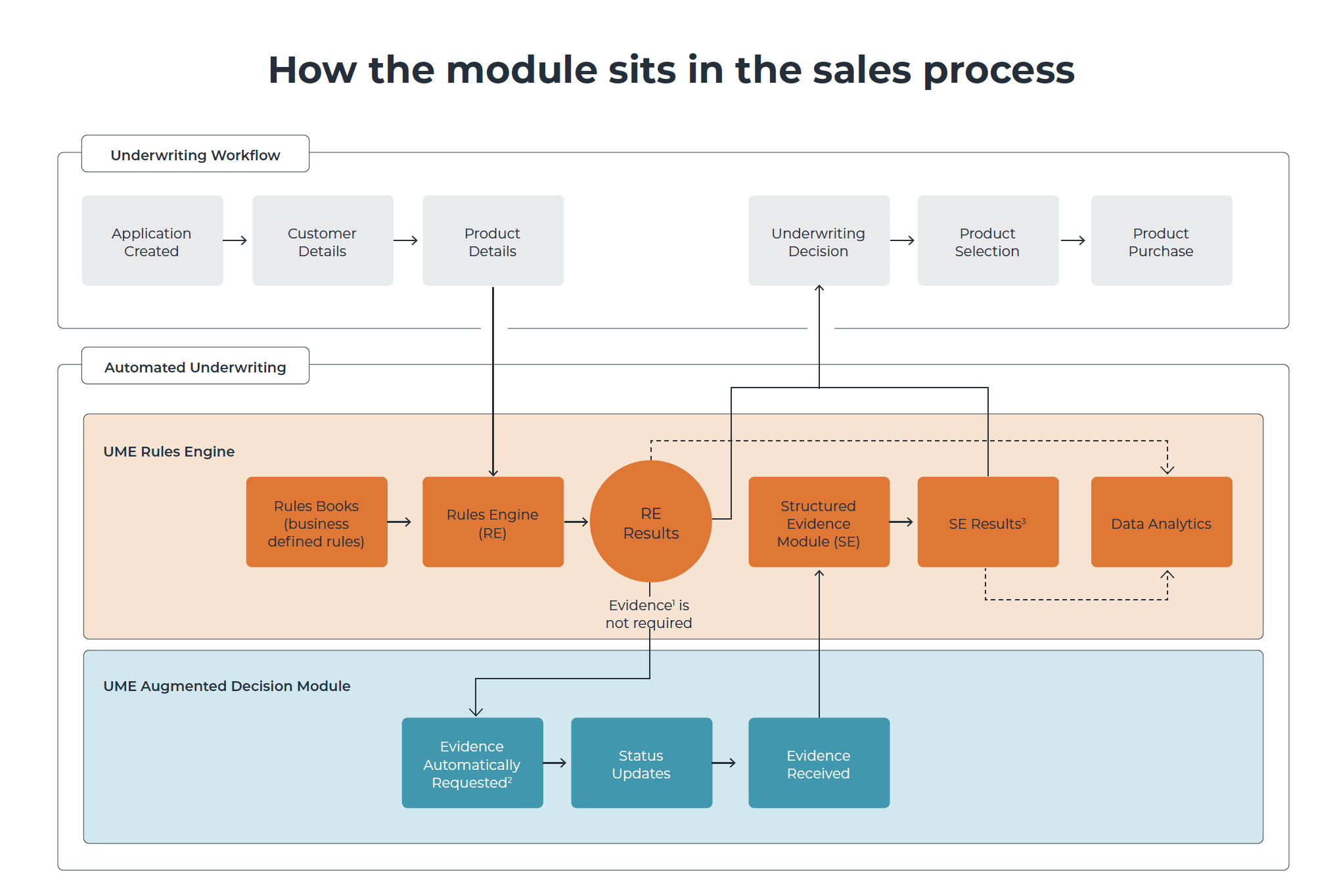

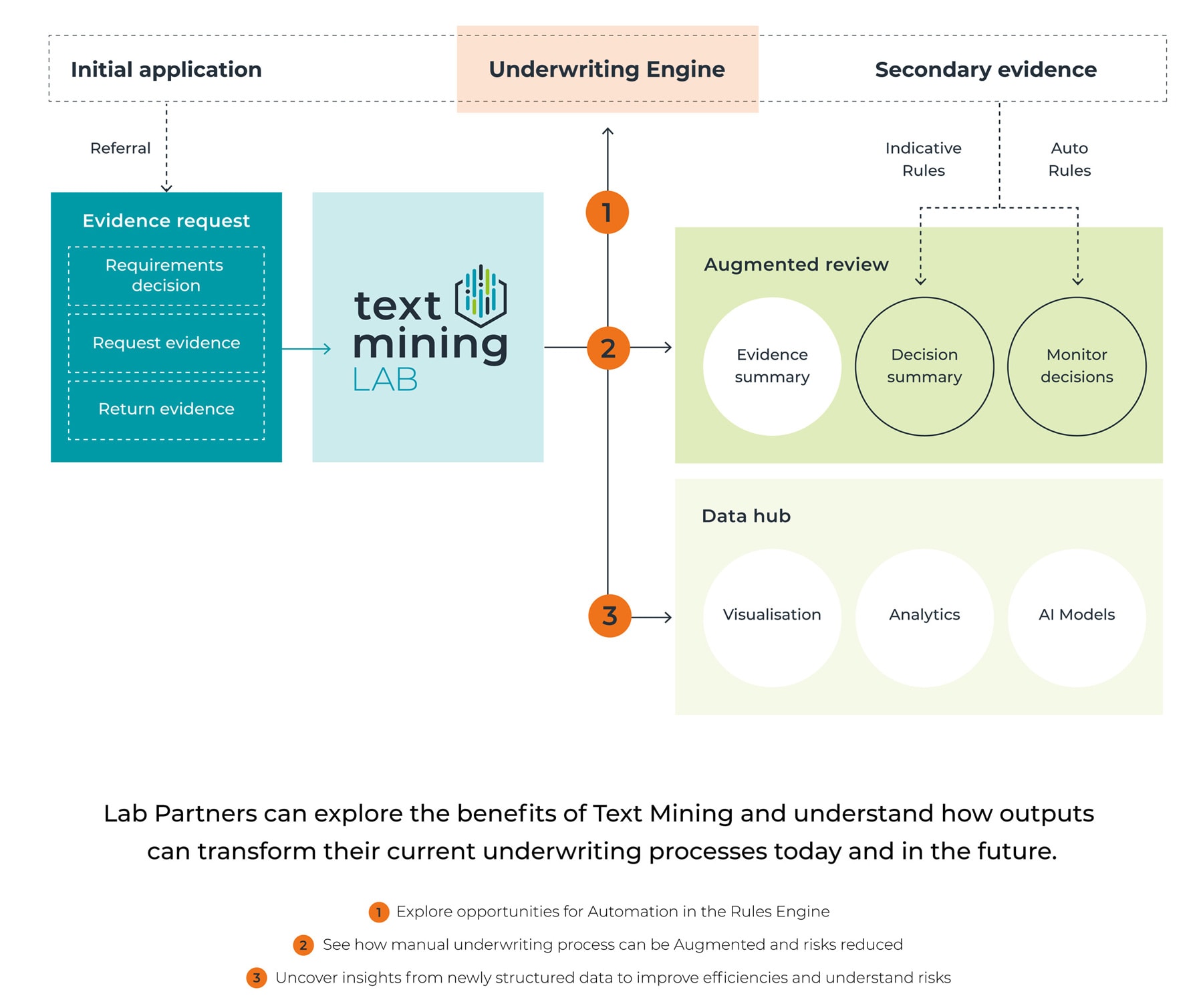

Digital automation is allowing insurers to speed up their underwriting process. One technique used in automation is the introduction of automated rules-based systems and AI text mining tools that search through medical records and data in a fraction of the time it would take an underwriter to perform the same process manually. While automation does provide quick solutions for a large volume of standard cases or cover protection, more complex cases are flagged where further evidence is required – such as doctor referrals or laboratory tests.

Tools like UnderwriteMe’s range of digital solutions, use automation to replace part, or sometimes all, of the invasive record searches; translating medical information into structured data, and reducing total underwriting time and discretionary APS in a majority of cases. Instead of replacing underwriters, automation allows them to focus their expertise on complex cases, or client handling.

According to Forbes³, companies that take the ‘leap of faith’ to digital insurance automation will completely transform the user experience, facilitating efficient practices that accelerate traditional workflows and speed up productivity if they can overcome the technological challenges they will face. But, how exactly does the ‘leap of faith’ of digital automation really impact the day-to-day underwriting process?

As well as streamlining the customer experience, automation seeks to remove judgement and subjectivity of human opinion by standardising the decision-making process across large volumes of applicants to provide a consistent quality. However, with PwC suggesting that 41% of customers are considering a switch in providers due to a lack of digital capability alone⁴, adding automation to your underwriting process is not only a case of satisfying demand to retain customers, but a just solution to reducing your drop off rates for prospective customers, too.

With that in mind, it’s important that insurance providers seek to add providers like UnderwriteMe to their inventory, not only because it’s what the customer wants, but to help bridge the widening protection gap⁵ in life insurance. With digital automation at the helm of your policy offering, insurers can now improve their customer experience, moving the cogs faster than ever through cloud-based services, allowing underwriters and other teams within the insurance provider to spend their time on higher value work.

Unlocking the value of digital transformation

Transforming your insurance company by implementing digital solutions is often associated with risk. Return on Investment (ROI) is difficult to measure – however, UnderwriteMe’s customer data shows that an average of 24% of cases required manual review across selected major UK insurers. With this data in mind, comparing the overall cost of digital implementation with a predicted reduction in manual handling will justify the switch to automated solutions.

There’s sometimes resistance when it comes to applying digital solutions to processes that traditionally require a heavy amount of training and experience to perform. UnderwriteMe’s automation platform has been built from the ground up by professionals with decades of experience in the industry. This means that as well as being intuitive from a customer and underwriter perspective, it’s also built with difficult-to-navigate areas, like mental health, in mind. Using experience to flag sensitive areas like this to underwriters, throughout the process, protects your company from reputational damage, as well ensuring future policy holders obtain the right level of protection they require.

On the whole, the benefits of improving the speed and accuracy of the underwriting process with the inclusion of automation far outweigh the potential risks, given the competitive pressures and the protection gap that insurers face. With experts like Deloitte recording that 65% of insurance providers in the US are expecting an increase in spend on automation in the next year⁶, it’s clear investing in new technologies that make the underwriters job more efficient without risk is where providers will be focused.

To summarise

Implementing automation as a digital solution to increase underwriting speeds, much like digital transformation on the whole, is not without its risks. However, it has benefits that, for insurance providers, are hard to ignore:

1. Efficiency for insurers

With a faster underwriting time, insurers can recommend policies to customers quicker, freeing up underwriter time and resources for more complex risk assessments or claims handling.

2. Improved conversion rates

Automation removes barriers to purchase stemming from delays in sourcing reports or information according to the availability of underwriters.

3. Customer satisfaction

Speeding up the policy offering process by using AI removes the subjectivity within decision-making of underwriters and creates best practices for data collection.

With this in mind, what’s the risk in learning more about automation in underwriting? Contact us to find out how digital automation with UnderwriteMe can benefit your business!

External Sources

1 – Statista – Value of the protection gap in the insurance industry worldwide from 2010 to 2020 with a forecast for 2025

2 – McKinsey & company – The Growth Engine: Superior Customer Experience in Insurance

3 – Forbes – Automation Can Change The Insurance Industry

4 – PwC – COVID-19, consumers and coverage

5 – Insurtech Insights – The Insurance Protection Gap: What is it and how does it affect the insurance industry and our quality of life?

6 – Deloitte – Insights: 2022 insurance industry outlook