April 8, 2024

Transforming Claims Management – The Power of Automation

By Steve Baldry, AVP, Underwriting, UnderwriteMe

Transforming Claims management – the power of automation

In today’s fast-paced world, we are constantly looking for ways to improve efficiency, reduce costs, and improve customer satisfaction. Claims are no different, and at UnderwriteMe we understand the challenges faced by Claims teams who are trying to meet demanding SLAs, with manual processes, and a customer who needs empathetic support.

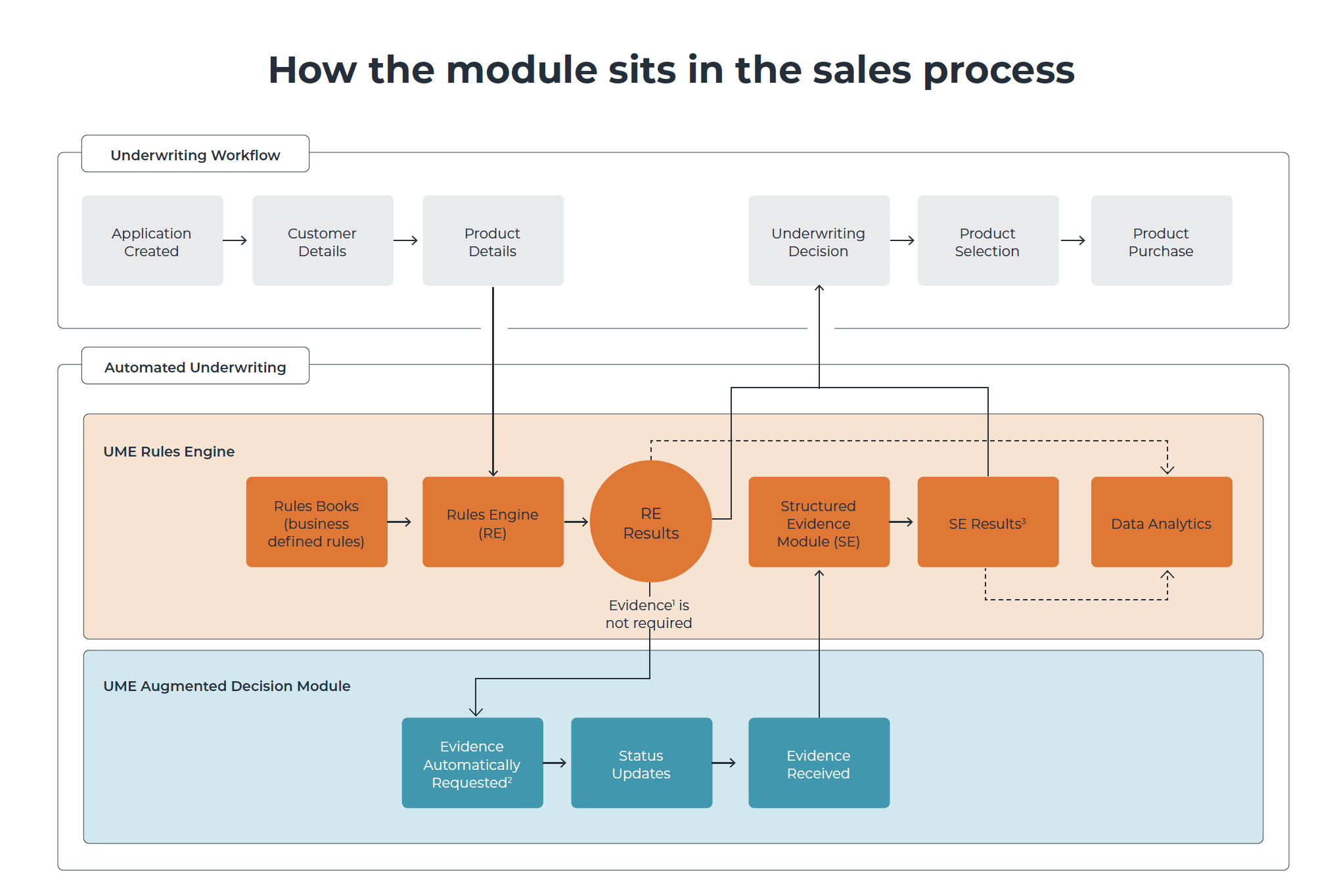

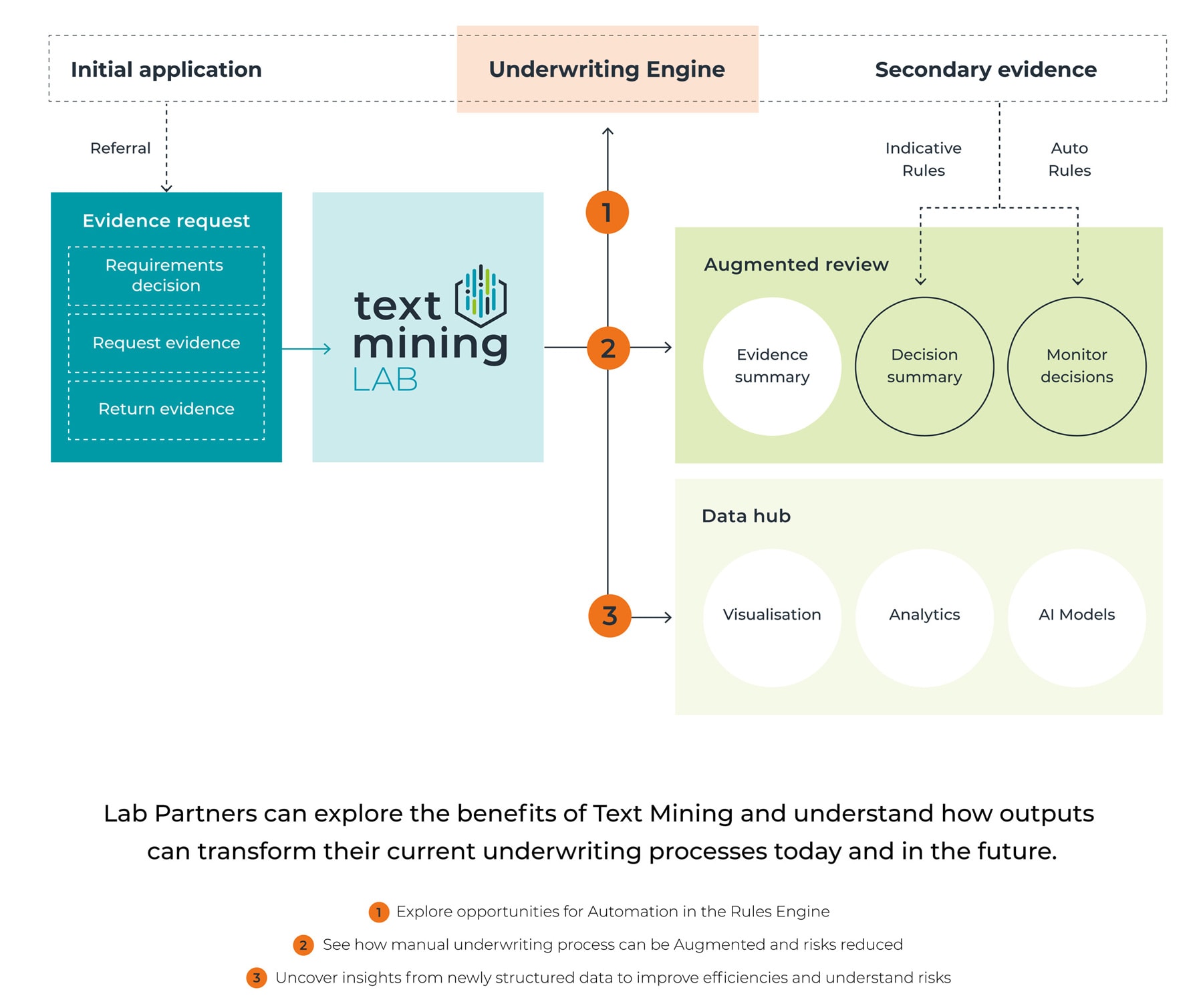

Meet our engine for Claims, the latest addition to our suite that is designed to empower Claims teams and the way that Claims are processed. Developed with a focus on resource efficiencies, people development, brand, loyalty, and customer needs. Our engine will transform the way insurers operate and service their customers in the same way as rules engines have been doing for underwriting teams for the last 15 years.

Recognising customer needs

At the heart of Claims is a commitment to customer service. We live in a digital world where chatbots and instant messaging are the increasing preference for many. However, you just need to read the many online studies, and you’ll find that around 70% of people still prefer to speak with a human than an online automated service. This need is increased during a claim, where a human touch is important. But the world is slowly changing. According to the Office for National Statistics (ONS), in 2020, over 91% of UK adults had access to the Internet, an increase of 1% from the previous year. And, since 2013, internet use doubled in the over 75’s. So, for all age groups, people are becoming comfortable being online. Just look at tomorrow’s customers – 73% of children aged 9-11 use a laptop or desktop*.

So, it’s important to scale for today’s and tomorrow’s customers. But digitising your journey doesn’t mean that you will lose the personal touch. Our engine for Claims is flexible enough to present a tailored journey, with real-time decisions, 24 hours a day. It is also intuitive enough to hand the claimant over to an assessor who can take the claimant through the process with empathy and understanding.

This way, our Claims engine and Claims assessors can work together to provide a truly customer-centric experience.

Efficient use of resources

Claims assessors are highly skilled and in demand. It can take as much as 2 years for a budding Claims assessor to complete a mix of on-the-job training and study to become independent, and much longer to attain a high level of expertise.

Our Claims engine introduces automation, and improved workflows into the Claims role creating an opportunity for claim assessors to improve their technical skills and adopt new processes. We believe that claim assessors of the future will be much closer in skill to underwriters. According to a 2020 Mckinsey report, the adoption of automation in the claims industry will likely lead to Claims assessor roles evolving into more innovative branches like Digitally enabled Claims handler, Complex-Claims handler, Claims technology-product owner, and Claims-prevention specialist.

In a world rapidly adopting AI in every sector, failure to adopt automation and innovative processes might put your team in a difficult position to attract young bright talent looking to work in forward-thinking organisations that utilise best-in-class technology and processes.

Your team can now recruit and train the best people and focus their time in continually improving your people, with new and better skills, at a lower cost.

Building scale, trust, and loyalty

As an industry, we pay nearly 99% of all Life and Terminal Illness Claims, but how modern are the processes sitting behind them? Our studies suggest that bottlenecks in the process can delay Claims by a week, and some Claims can take much, much longer. Delays are often unavoidable, but where they can be avoided, do we want our customers waiting weeks or months for us to process their claim at the point where they need the money the most?

Our product introduces smoother processes that speed up Claims decisions, ensuring that customers receive consistent support at every touchpoint. Insurers may even choose to enable straight-through claim assessment (the underwriting equivalent of straight-through processing) by removing touchpoints between filing and payout. With faster response times and smoother workflows, insurers can scale up their operations, publish quick turnaround times, and build trust, loyalty, and lasting relationships with their customers.

We’d be really interested in hearing your thoughts. Do advisers place a high value on service as well as Claims certainty? Are insurers inclined to prioritise process improvements at this critical stage of the customer journey? Do you believe that we need to embrace the digital world in what, to the customer, is THE most important aspect of their relationship with the insurer?

If you’re interested in seeing a demo, or finding out more click here.