DecisionPlatform

Build the solution that's right for your business

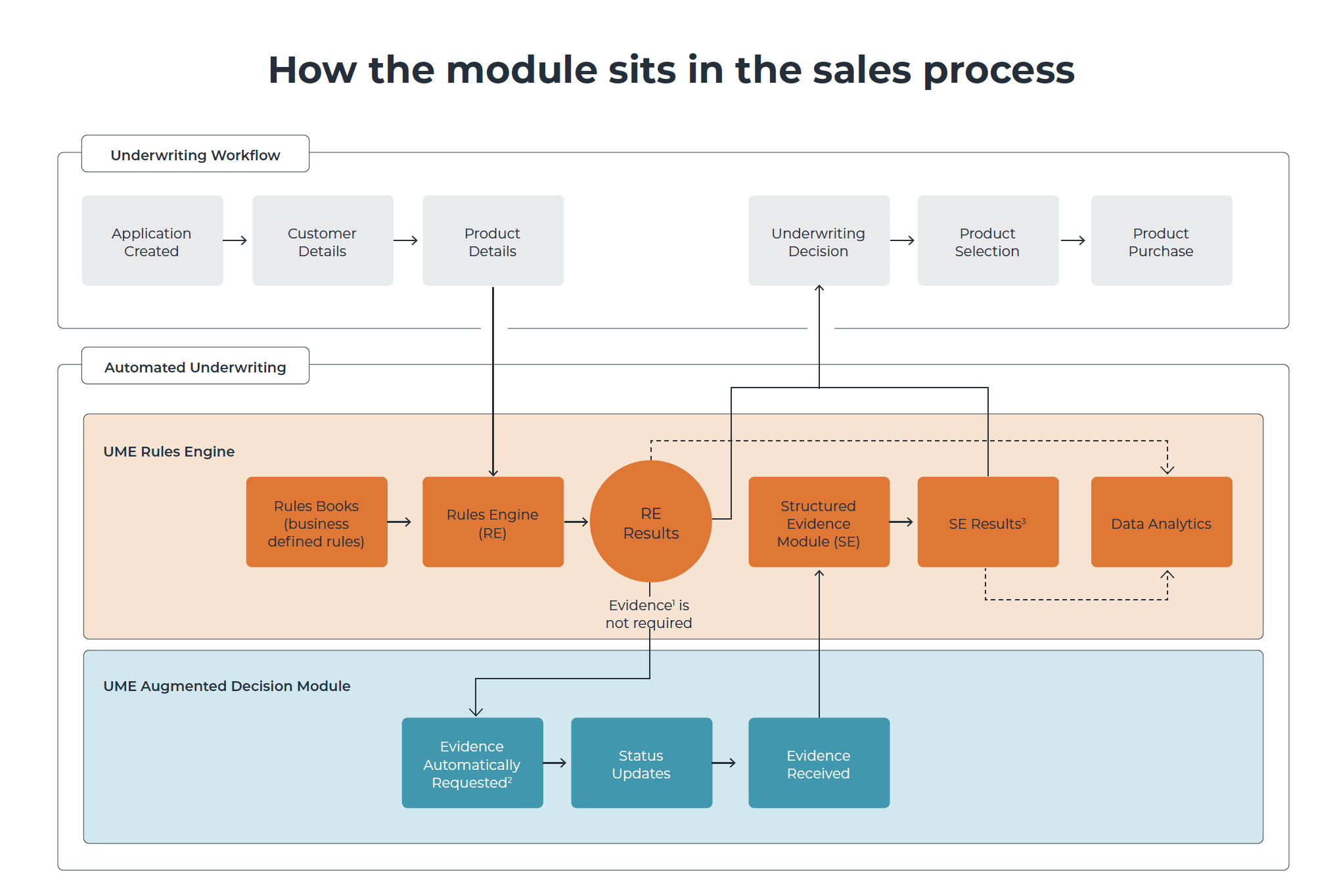

Take control of your underwriting process with our Underwriting Engine

Our Underwriting Engine helps insurers maximise control of their rules and increase efficiency of their underwriters. Insurers can quickly and easily design, amend, test and update rules or use the pre-set rules straight out of the box.

How Underwriting Engine will accelerate your underwriting operations

Take control of your underwriting

Easy to maintain, amend and adjust questions or use out of the box rules. Underwriters can be self-sufficient to build the rules set that works for their business and customers.

Improve customer engagement

Meet your customers’ digital expectations of immediate purchase and buy now experience by increasing straight through processing rates by automating more decisions.

Grow at scale and speed

Increase agility by launching new products and channels quickly and cost effectively without significant IT involvement.

Drive innovation

Test new rules and react quickly to changing market conditions so you can stay ahead of your competitors and offer new and innovative protection products to the market.

Keep your customer data secure

Our cloud-based technology is safe and secure to protect customer data and ensure compliance with regulatory requirements.

Deliver a better customer experience

Tailor questions to quickly get the information needed to make timely and transparent decisions.

How Underwriting Engine will accelerate your underwriting operations

Take control of your underwriting

Easy to maintain, amend and adjust questions or use out of the box rules. Underwriters can be self-sufficient to build the rules set that works for their business and customers.

Improve customer engagement

Meet your customers’ digital expectations of immediate purchase and buy now experience by increasing straight through processing rates by automating more decisions.

Grow at scale and speed

Increase agility by launching new products and channels quickly and cost effectively without significant IT involvement.

Drive innovation

Test new rules and react quickly to changing market conditions so you can stay ahead of your competitors and offer new and innovative protection products to the market.

Keep your customer data secure

Our cloud-based technology is safe and secure to protect customer data and ensure compliance with regulatory requirements.

Deliver a better customer experience

Tailor questions to quickly get the information needed to make timely and transparent decisions.

“By digitising and simplifying the underwriting process, we also reduce paperwork or our more than 5,000 financial consultants so they can spend more time engaging with their customers and advising them on their financial needs.”

Goh Theng Kiat, Chief Customer Officer, Prudential Singapore

“By using UnderwriteMe, we can now create a more engaging and consistent application process between the adviser and the consumer, as well as process new business at a much faster rate without having to increase our underwriting resources.”

Mick Jones, Chief Underwriter, MLC Life Insurance

Get in touch

Contact us to learn more about how to improve your underwriting processes.