April 24, 2023

Simon Jacobs talks about the recent changes in the Protection Industry

This is a challenging time in the Protection Market. Two brands – Canada Life and then Aegon – have closed to new business. The industry is still navigating back from a global pandemic. Consumers are tightening their spending as prices rise.

Fewer choices can sometimes be a bad outcome for the consumer, but the industry remains strong. Our products remain instrumental in providing peace of mind to millions of customers and their families.

Industry insiders instinctively understand the value of Protection. We need to ensure the customer of today has a deeper understanding of their product and feels valued by their provider.

Opportunities for growth still exist, and in a cost-of-living crisis, advisors are in a unique position to deliver value to consumers.

The Protection customer of today is increasingly likely to be from a generation where most purchases are instant and digital, with low barriers to delivery. Automation is everywhere, as is understanding a customer as an individual through the power of data.

Now is the ideal moment to reflect and take stock of how we will continue to keep customers engaged and communicate the value of Protection products. We will continue to strive for inclusivity and fairness. This requires adapting our approach based on the customer. Some customers will always require human intervention, but all customers expect and deserve a seamless purchase journey.

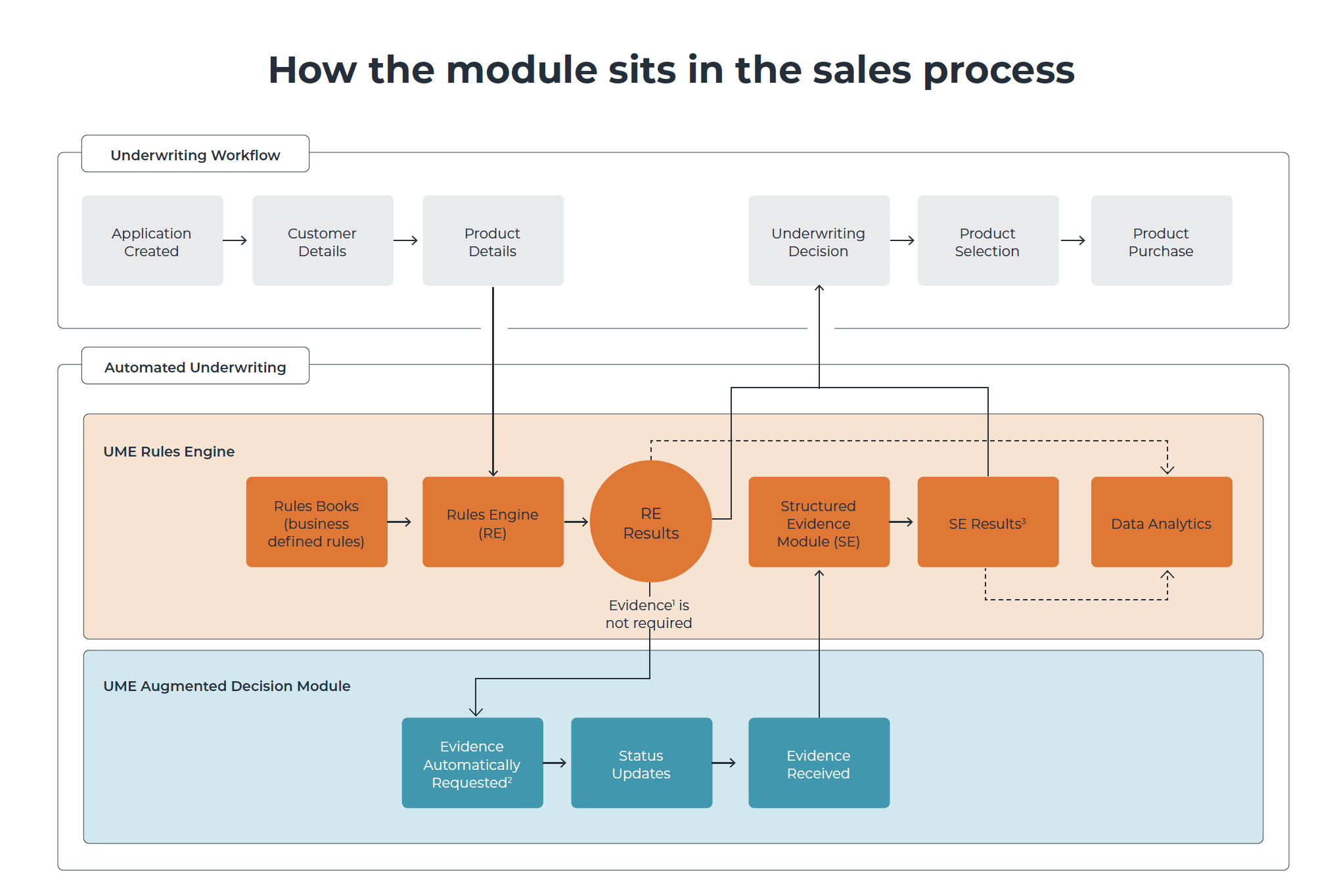

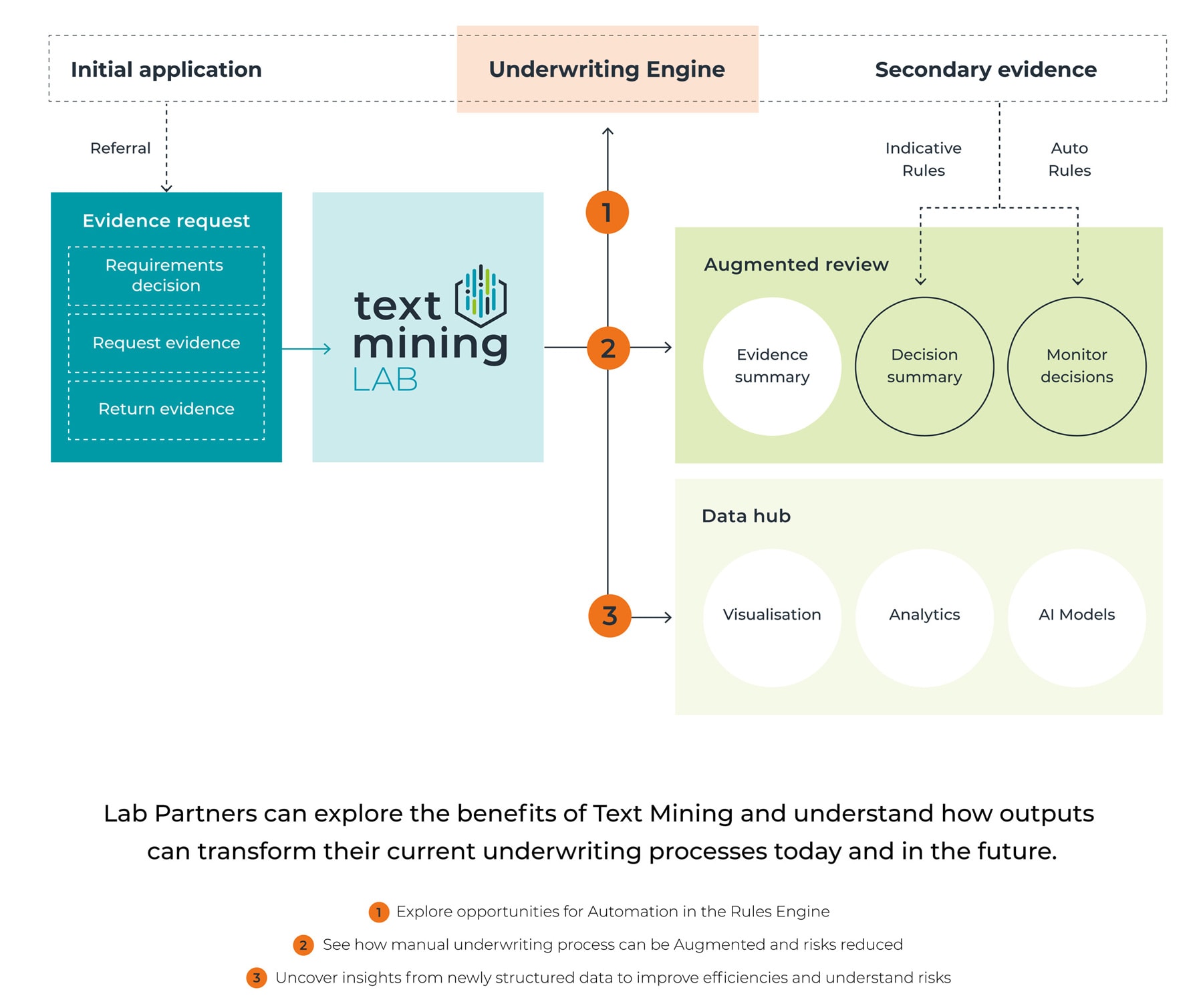

As an industry, we will continue to push forward with automation, improving outcomes at the point of sale and cutting delays for those customers with more complex medical histories requiring additional medical information. At UnderwriteMe, we have successfully automated the provision and processing of medical examinations and blood tests – avoiding delays for customers who have made a greater effort than most to obtain Protection cover.

Beyond the sale, showing customers we care by communicating clearly and empathetically with them at the time of purchase and throughout the life of their policy is more important than ever. We’d love to hear from our insurer community about what’s the most important issue for the industry over the next few months… We’ll be putting a poll up on our LinkedIn to see what you think later this week.