August 17, 2021

Prudential Malaysia enhances customer experience with UnderwriteMe technology

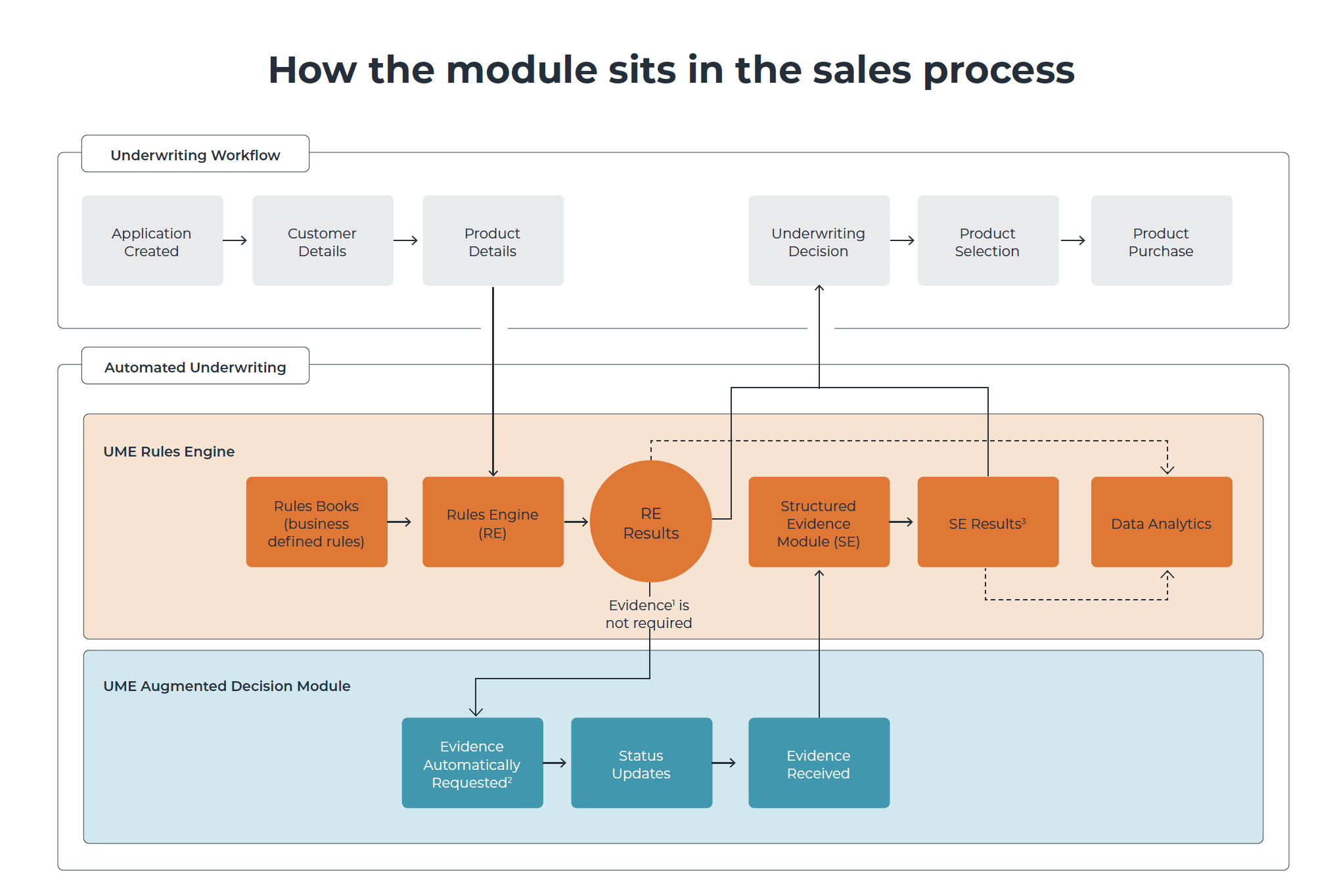

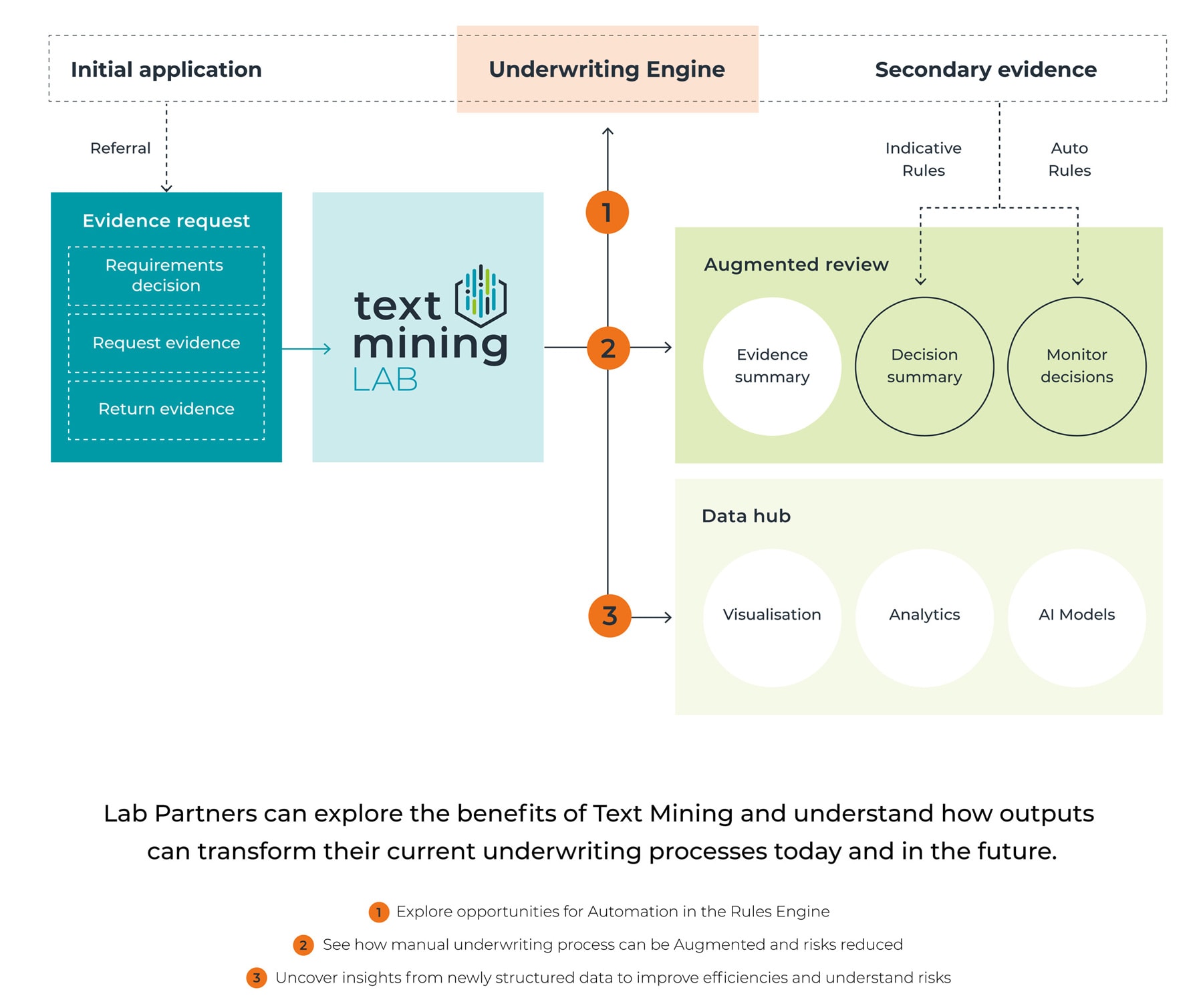

Singapore, 16th August 2021 – Prudential Malaysia (PAMB) has recently launched UnderwriteMe’s Underwriting Engine, enabling the insurer to provide faster underwriting decisions and enhance the insurance buying process for customers. More than 20,000* PAMB agents will also benefit from the Underwriting Engine, which reduces their paperwork and allows them to focus on engaging and providing advisory services to the customers.

This is the second implementation of UnderwriteMe’s Underwriting Engine with Prudential following the inaugural launch in Singapore. The project was the result of a truly collaborative approach from both teams, as well as a timely solution that meets the needs of both customers and agents amid the unprecedented pandemic situation.

Paul Hughes, Head of Asia Pacific at UnderwriteMe, commented: “We’re excited to see our technology help Prudential Malaysia deliver faster straight through processing capabilities supported by a customer journey that is highly tailored and relevant. The Underwriting engine delivers this with a customisable question set and analytics to provide actionable insight.”

One of the objectives of this innovative tool was to deliver the ability of underwriting results even where the agents may be offline or not connected to the internet. UnderwriteMe’s Underwriting Engine comes with the capability of providing immediate underwriting decisions on tablets at point of sale without the fear of uncertain internet connectivity.

Lim Eng Seong, CEO of Prudential Assurance Malaysia Berhad said: “Our aim is to provide a seamless customer experience and we strive to make the purchase and application process as hassle-free as possible. We are very pleased that with this new digital underwriting tool, we are able to issue policies within a few hours and provide peace of mind to our customers more quickly.”