July 15, 2019

MLC Life Insurance halves underwriting approval times with UnderwriteMe technology

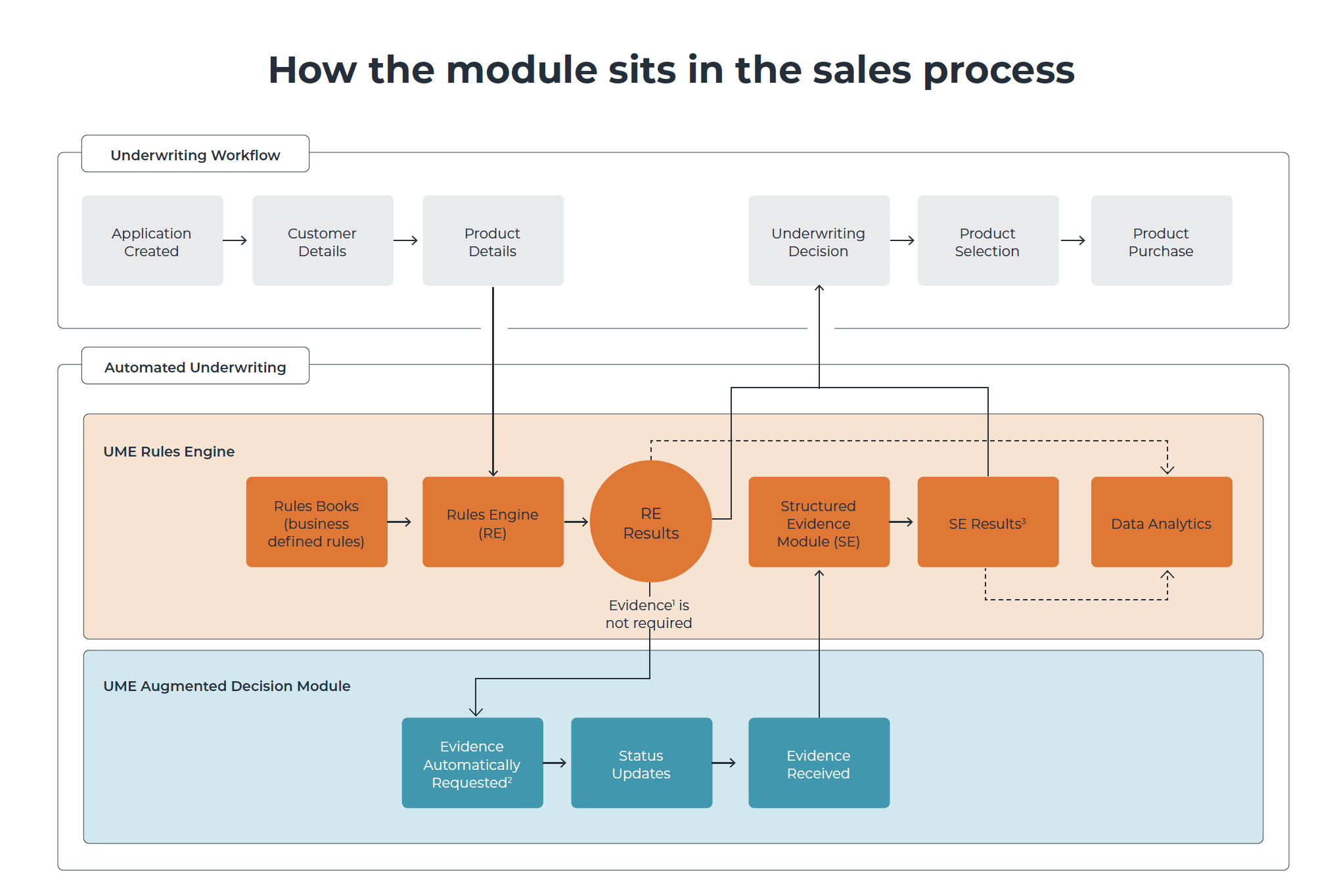

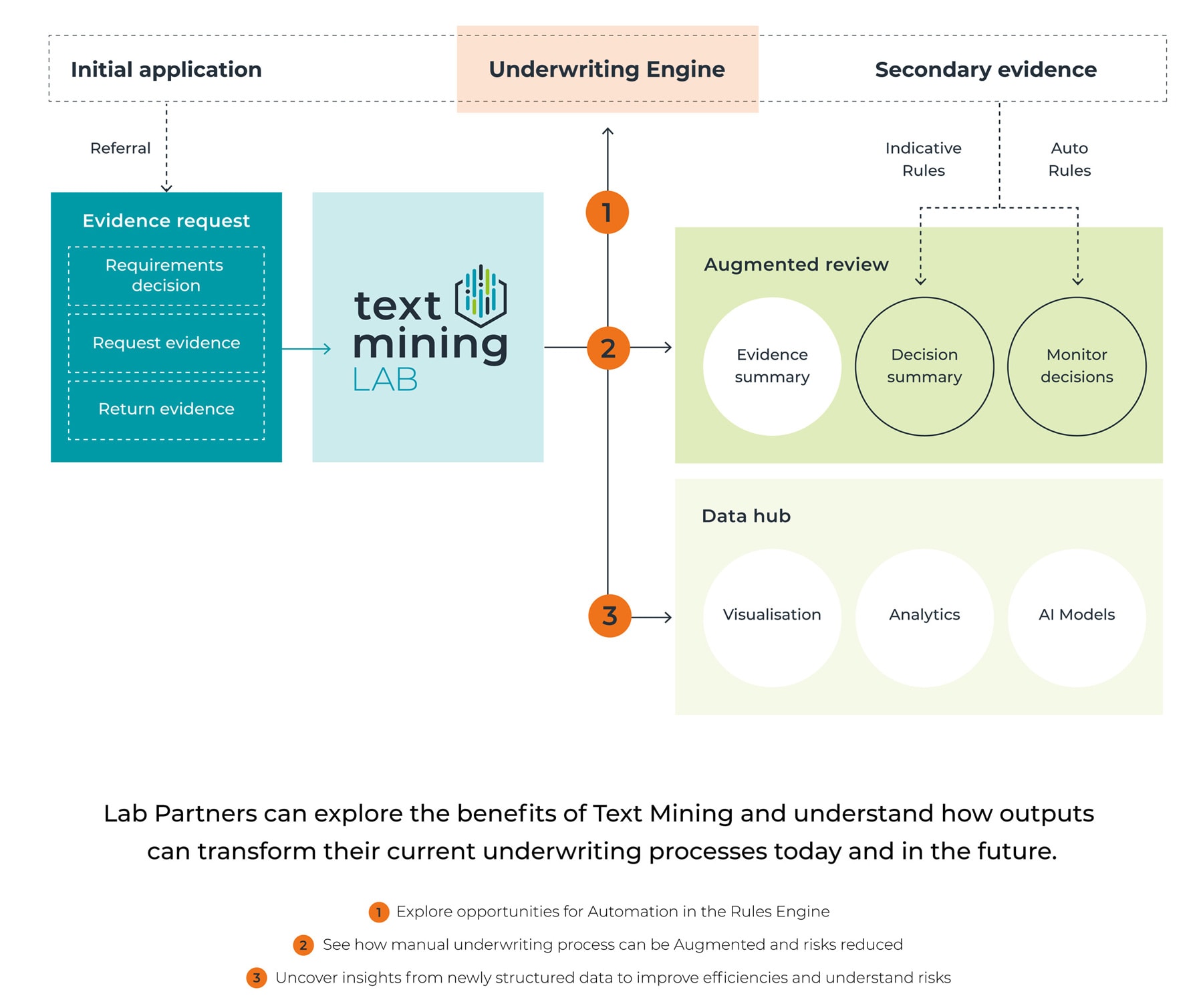

Life insurers in Australia are facing persistent scrutiny amidst a challenging and competitive environment. Despite this environment, MLC Life Insurance has successfully made the process of purchasing life insurance easier and faster for its customers, having halved the time it takes to assess and admit a customer’s life insurance application. MLC Life Insurance attributes a significant contribution of this success to its $500 million transformation program, including implementing the core solution of UnderwriteMe’s Underwriting Rules Engine, powered by Pacific Life Re.

Since the implementation of its new digital underwriting platform in April 2018, the life insurer has seen a 10% uplift in completions, creating a more seamless journey for customers and an easier application process for advisers. In addition, because of the modifications made within its underwriting rules, there has also been a 20% reduction in the amount of medical information requested to support an application. These modifications have further enhanced the application process and have helped to make it easier for customers to obtain insurance.

Since the launch of the platform, more than 7,200 policies have been accepted automatically, without the need for any manual underwriting, with underwriting decisions being made on almost 55% of all benefits applied for, including Life, TPD, Critical Illness and Income Protection. Using data from applications, the life insurer has focused on continual refinement of its underwriting rules, resulting in 25 new rules being released over the past 12 months.

Customers have responded positively to the insurer’s new technology offerings, which included a promotional 10% discount on cover for customers purchasing life insurance through its underwriting platform. Combined, these initiatives have increased digital up-take by 20%.

Head of Client Solutions at Pacific Life Re Australia, Tyson Johnston, said, “It has been an impressive year for MLC Life Insurance and they should be very proud of halving the time it takes for their customers to receive cover. We are delighted that UnderwriteMe’s Underwriting Rules Engine has enabled them to improve their processes and ultimately the experience for their customers.”

UnderwriteMe Director of Business Development Asia & Australia, Rakesh Kaul, said, “MLC has used the power of UnderwriteMe technology to modernise the way life insurance is underwritten and in doing so, has unlocked huge growth potential.”

Mick Jones, Chief Underwriter, MLC Life Insurance, says the results show the platform is delivering clear results for both advisers and customers.

“Since the launch of the platform last year, the feedback from advisers and customers has been really positive. By using UnderwriteMe, we can now create a more engaging and consistent application process between the adviser and the customer, as well as process new business at a much faster rate without having to increase our underwriting resources.”

“Innovation in underwriting is a key part of our transformation program, building our technology platforms to help put in place the capabilities to be successful in the future and ensure we deliver a great customer and adviser experience,” said Mick Jones.